COVER STORY

A MAN ON A MISSION

Every path in our industry eventually crosses everyone else’s trail. The path taken by the man on a mission featured in this cover story only recently crossed mine. I welcome the opportunity to bring his story to you and generate front-and-center attention for an incredible human being. Grant LaViale stood out to me and first came to my attention on social media waves. His was consistently a voice of positivity….

Featuring Contributing Writer, Laura Brandao

Build it and They Will Come! The Birth of NAMMBA

I remember the day clearly. It was back in 2016. I said, “I’m here today because every conference I attended over the last two to three years has showed me we absolutely need more diversity, we need more women, and we need more young people. Quite honestly, our industry is not doing enough.”

Featuring Contributing Writer, Ray Befus

Three Easy Tools to Overcome Stress

If we can agree on anything, it is that 2020 has been a season of unusual stress. …chronic stress; stress, day in and day out, over months due to ongoing financial pressures, toxic relationships, isolation, or impossible demands at home or work, can morph into brain fog or even depression.

Featuring Contributing Writer, Ruth Lee

Place Thy Thumb Upon the Scale

On August 12th, mortgage bankers on distribution lists across the country received shocking news and every secondary and capital markets’ professional blanched in unison. Numbers were crunched and Zoom meetings were held. This was going to be a hard pill to swallow. With two weeks’ notice there would be no time to make adjustments to rates on loans in the pipeline…

Featuring Contributing Writer, Rhiannon Bolen

Are You A Virtual B2B Professional?

The mortgage industry is incredible right now with record-breaking months, historically low rates, productivity through the roof, advances in automation, and our ability to work from home with no interruptions we would otherwise experience in our office setting!

And yet, I am bored.

.

Featuring Contributing Writer, Ana Maria Sanin

BRINGING VISION TO LIFE —

With a brand speaking directly to your audience!

What do you think of when you hear the word vision or visionary? I think of possibilities far above reality. We each have the ability to visualize dreams and goals.

I

n this edition of The Vision we share incredible stories of leadership, business, marketing, and life tips, industry news and forecasts, and a culture of growth and positive community.

In the Coaches ConnXion, we collect the wisdom of our coaching team in timely and pertinent articles written by 20/20 Vision coaches. In future months, we will augment these with articles from across the breadth of the coaching profession.

Eyes on News offers a fast look at newsworthy reports from across the mortgage and real estate industry. Bolstering the current events and fast pace of this industry, we’ve added to both the Books and More section and the Happenings and Events section. Check them out and please do submit ideas and suggestions!

It is amazing to me to see how this magazine has come together and is growing organically. We hope you enjoy each of the features and stories we’ve brought to you in these pages. We are already working on the next issue of The Vision, which will publish on December 1. And of course, on November 2, the Women With Vision Magazine will publish as well.

In the meanwhile, enjoy today’s issue and please share www.TheVisionMag.com in social media. Reach out and congratulate your peers who are honored in these pages. Tag them in your posts #thevisionmag and #2020visionforsuccesscoaching.

As we attempt to return to our lives in some way, shape, or form of normality this fall, it is evident we are working incredibly hard. It has been a year for the history books and the record books. The combination of events has led to a lot of gratitude and fortune for our industry and a lot of stress and anxiety.

As the President of 20/20 VSC, I see the flow of professionals in and out of our coaching division selecting expert coaches to help them manage their businesses and their lives. The need to pay attention and heed what our body and minds are telling us is apparent in the discussions we have every day. My message this month is pointed, and I hope timely.

Take a nap.

Unplug.

Give yourself grace to recover each day.

Do not beat yourself down with your unfinished to-do list.

Remember, you MUST bring the car in for the pitstop when racing, you MUST change the tires and check the oil. This is sound advice and is an emergent leadership message you must listen to, although it may sound counterproductive.

To succeed, we must pay mind to boundaries and the need to refill our energy levels. Workout. Eat well. Sleep and laugh. Play and create. Read. Write and speak your thoughts. Sing. Jump and skip. Be active and present.

At the end of this strife-filled year, I hope what most lingers in our minds is how at this time and moment in our careers and lives we were paid huge life dividends and the memories are laced with joy. Be mindful of the balance.

.

WRITE FOR US

Yes, we do accept submissions. If you are a writer interested in being featured in a national publication, we will be happy to consider your ideas and your article submissions. We are also interested in recurring columns centered around our featured topics. The place to start is by clicking the button and inquiring.

20/20 Vision for Success Coaching

A MAN ON A MISSION

Written by: Christine Beckwith

very path in our industry eventually crosses everyone else’s trail. The path taken by the man on a mission featured in this cover story only recently crossed mine. I welcome the opportunity to bring his story to you and generate front-and-center attention for an incredible human being.

Grant LaViale stood out to me and first came to my attention on social media waves. His was consistently a voice of positivity. He represented himself as an established and polished leader. He was incredibly poignant in his exchanges with his staff and onlookers. It was apparent even from my long-distance social view Grant was someone to watch.

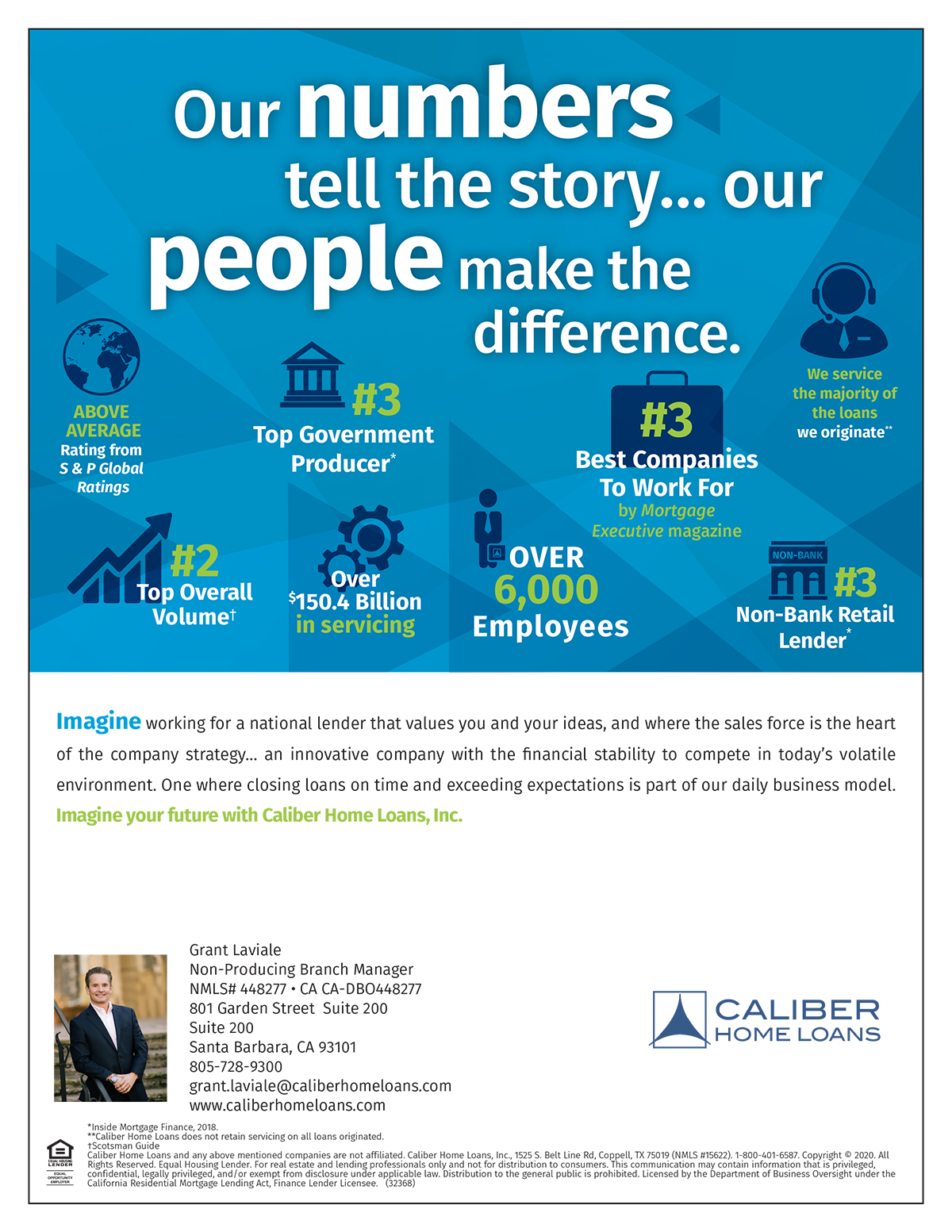

He intrigued me; I admit. I engaged and commented on his posts and we took the first steps to create a digital relationship. It did not take long before we found common ground in a mutual leader, Dennis Hueman. Both Grant and Dennis work for an incredible, proven company whose brand, in and of itself, stands out amongst its peers, Caliber Home Loans.

When Grant and I realized we both knew Dennis Hueman, our casual conversations moved into three-way discussions and, for me, a nostalgic reconnection with Dennis. Grant knew Dennis through a current leadership reporting role and Dennis and I were previous colleagues. I reported directly to him when he was EVP and I was SVP of Sales at H & R Block Mortgage.

At one point, Dennis and Grant asked if I would sit in on a sales meeting with their flourishing team to share inspiration and relevant sales advice, which of course I happily agreed to do. Shortly after the meeting Grant and I, along with several of his subordinates, developed a professional coaching relationship. This is when I truly came to appreciate the incredible and exceptional leadership skills Grant LaViale possesses.

One of the traits I consider a bonus in myself is an ability to accurately judge character. I have always had a sense of recognition when meeting a good person. My people radar with Grant proved to be spot on. It is now many months since our paths first crossed. I’ve sat with him for hours across weeks and months, talking about business and diving into his self-development. In my mind and in reality Grant represents a positive cliché: the superb athlete mentality. He is a guy whose already strong game is continually building and strengthening and who sharpens his craft daily in the trenches of professional activity. His business prowess and expertise play out in real time, in the industry battles leaders who show up for emergent management take on daily.

To be a manager and leader and perform one’s duties in the kind of environment the year 2020 has brought to us is an accomplishment. To relentlessly perform daunting tasks, without complaint, to calm professionals drowning in the rising and unforgiving tides of volume and volatility is not for the faint of heart. I have been honored to watch Grant perform his duties. He has given me cause to pause at times, standing in awe as he, despite needing to wrap the safety line around his own waist as the waters rose, was able to help others consistently, passionately, and with integrity. It was, and is, an amazing sight.

To be a manager and leader and perform one’s duties in the kind of environment the year 2020 has brought to us is an accomplishment. To relentlessly perform daunting tasks, without complaint, to calm professionals drowning in the rising and unforgiving tides of volume and volatility is not for the faint of heart. I have been honored to watch Grant perform his duties. He has given me cause to pause at times, standing in awe as he, despite needing to wrap the safety line around his own waist as the waters rose, was able to help others consistently, passionately, and with integrity. It was, and is, an amazing sight.

Grant, like many professional leaders, understands his duty is to perform despite personal weathering. He stands tall amongst leaders, perhaps most significantly in a way invisible to most. Behind the scenes of his leadership he shows no faltering. He comes to the management table to talk and to share his thoughts, to gain advice, and sometimes to strategize or bounce a situation or idea against the wall. He does so while speaking kind words, encouraging positive outcomes, and with an inner belief the work he is doing does matter.

And it does!

Grant’s career path is at an interesting intersection. He is the guy between the frontline troops and the corporate office, teetering between the inexorable rise of these two suns. One casts light on a necessary job to do, the other casts the shadow of toeing the corporate line. In any year, this is a challenging role. It is no small duty this year with the burgeoning consumer palate for refinancing. The record breaking, through-the-roof volumes have tested the foundation of every company in our industry. Coupled with a pandemic, many professionals are left digging themselves out of piles of work, often with one hand tied proverbially behind their backs by changing government regulations. Grant has been with his people helping them weather the storm. Together with Caliber, he has stood the test of this onslaught of volume and risen to produce products and services consumers rely on.

Dennis Hueman, when asked about Grant, said, “If you could imagine a leader who leads with the strength and determination of a rhino, the speed and agility of a cheetah, and the constant adoration garnered by a lion, you have Grant LaViale.”

Those same traits Dennis sees in Grant, I see in both men. Dennis Hueman has made a career of hiring and nurturing successful people. Recently, Grant held a safety webinar for his associate realtors in celebration of Realtor Safety Month. Dennis was there, sharing the good word to create and bring value.

Like all of us who lead, Grant wants to have his subordinates drink from the well he sustains for them. Encouraging them to coach with our firm and self-develop is one such aspect of his leadership.

What is the measure of a man? Of a Leader? Grant was visibly stunned when told he would be featured on the cover of The Vision magazine. True to his character, he felt undeserving and humbly asked why. The answer to that question is evident in all we’ve spoken of here. He is a shining example of leadership and self-development who draws from the core of who is for the benefit of his organization. He deserves the spotlight simply because his story is worthy of telling.

In Grant’s own words, here is his story. It’s about career, family, and an incredible life.

Q

How did you start in the mortgage business?

I started in finance working for Transamerica Financial in my early 20s. I was recruited to join First Interstate Bank as assistant vice president, where we tripled sales production overall, becoming a Chairman’s Club recipient. After Wells Fargo conducted a hostile takeover, I joined Washington Mutual as vice president. I thrived there, gaining experience and mastery of skills. At one point I was asked to revive a loan center where the manager and entire team had departed, taking $600 million in annual production to a competitor. It took time, and eventually we built the volume back up and exceeded it. This proved to be one of the most challenging yet rewarding times of my career, for sure. I had the honor of becoming a Chairman’s Club and Director’s Club recipient.

Washington Mutual was later acquired by Chase Bank, who unfortunately did away with home loan center models focusing on bank model origination only. I was forced to advise my staff of 27 individuals, including myself, we no longer had a home. This was easily one of the saddest moments of my career. We did not see it coming. I had one hour to tell everyone of the change.

Fortunately, Wells Fargo Home Mortgage had a leader depart. I was asked to come into what was essentially the same situation and revive their home loan center. It was $750,000 in the red upon arrival of my acceptance. I quickly returned the cost center to profitability.

After four years, I felt the need to make a bold move. It seemed to me our clients needed and deserved a better experience. When I was asked to join Caliber Home Loans it was not an easy decision. I was scared to death of this move. It would involve a complete transition from a cultural perspective. As the sole provider for my family, failure was not an option.

Moving to Caliber was and continues to be one of the most significant decisions I have ever made. Eight years later, we continue to thrive. I went from steering a large cargo ship to steering a speed boat. Think about that in terms of both boats needing to get to the same location, and you will understand the difference between the models.

Q

What would you consider to be your greatest lesson?

Always be true to who you are. Believe in yourself no matter what.

There have been times when I was tempted to change who I was because others were doing something different and winning in that moment. I nearly went to the dark side. Remembering to be myself helped me to realize just because others do something doesn’t make it right, as we often see years later.

My best friend of over 30 years, who came to this country from Jamaica with nothing but the clothes on his back, says this to me from time to time, “Grant, what I love about you is you’re the same person I met 30 years ago. You haven’t changed.”

It means a lot to me as he has seen me in difficult situations.

Q

Do you have a favorite quote?

“If being successful were easy, everyone would be.”

Easier said than done.

Q

What is your greatest joy in leadership?

Hands down, joy in leadership comes from genuinely helping and watching people grow and achieve their goals, seeing their vision come to life, and living a life complete with passion. The people I serve are an extension of my primary family. I spend more time with them than my actual family. I take pride in being a mentor for my business family. I see myself as a proud parent. My high comes from helping others achieve their desires and dreams. What an incredible luxury I have to be able to do that.

Q

Do you have any top lessons to share with our readers?

Family First. We lost my father to prostate cancer. He was my idol and he left us before his 52nd birthday when I was only 21. When my mother became ill with cancer ten years later and entered hospice, I took care of her until she passed away on my birthday. Shortly after, I lost my best friend, my brother. He didn’t even make it to 50. You know, he never went for annual physicals because he was skinny and generally in good shape. Yet he died of an enlarged heart, something both treatable and easily diagnosed during a routine physical. This lesson is simple. Life is short. It’s easy to think, I will do it tomorrow. But will tomorrow come?

You can never be too Humble! This is something that I have made an effort to work on throughout my life, and it has taught me many things. I respect everyone, regardless of status or income.

If you shine shoes for a living, then polish the best shoes in town. My first job was washing dishes in a Chinese restaurant. I was excited when I was promoted to busboy. The chefs made me the best pot stickers because I washed the dirty dishes better than they had ever seen.You must continue to grow and learn regardless of age, status, or wealth. Perhaps this can be called fear of failure, but no one wants a dull blade in the shed when they need to cut something. Allow yourself to learn from others, including subordinates, and children. Everyone has value they can share.

Q

Would you like to tell us about your family?

I am blessed to be married to my beautiful wife, Yazmin, who keeps me on my toes, along with our three children, Courtney, Blake, and Yoselin. They make me proud daily and give me the motivation to do what I do.

Q

Where do you see the future of the industry going?

I see the future of mortgage growing more savvy in technology, providing additional tools for the right loan advisor to succeed. I say loan advisor because if you are genuinely not offering sound options and advice, you will quickly become irrelevant. For example, when a client calls to say they want to purchase a home with 20% down and one takes the application, they have failed! Perhaps it would be better for the client to put 10% down and consolidate debt instead. The transactional loan officer with high technology will disappear quickly as the technology will handle it for them.

The legacy of leadership Grant is developing at Caliber will leave an imprint on all he has touched. It seems trial and tribulation have not jaded Grant’s heart or his mission. In fact, in creating our cover title for Grant’s story the word “mission” came to mind because, like those beautiful people who dedicate themselves as missionaries to a cause or religion, a purpose, and a community, Grant is a missionary of the mortgage industry. He has helped countless people on their journey for decades now. He has shown up to do the hard work, to say the difficult things, in many cases to show them to the door and to help them overcome in the direst of situations.

Today he is the same man on a mission. Showing up and helping people through this year’s storms of high volume and volatility. He will undoubtedly be remembered by all he touches as he moves with grace, he speaks with intention, and he takes care of others’ feelings in an impressive way.

Most of all, Grant LaViale walks the walk. He sets the example many aspire and he’s still going, still reaching, and still on a mission.

Christine “Buffy” Beckwith is an Award-Winning Executive Sales Leader who has spent the past 30 years in the Mortgage finance industry. Her life and career are filled with a progression of success stories that reach all the way back to her childhood. A Best Selling and Award-Winning Author, Christine branched out in 2018 to begin her dream job as the Founder and President of 20/20 Vision for Success Coaching & Consulting. After breaking glass ceilings in the Mortgage & Banking Industry, Christine now is a columnist for professional magazines and is a special correspondent anchoring the news and interviewing experts in her industry. She is an advocate for women, dedicating a complete division in her own company to the cause and communities she touches at a vast level.

Christine “Buffy” Beckwith is an Award-Winning Executive Sales Leader who has spent the past 30 years in the Mortgage finance industry. Her life and career are filled with a progression of success stories that reach all the way back to her childhood. A Best Selling and Award-Winning Author, Christine branched out in 2018 to begin her dream job as the Founder and President of 20/20 Vision for Success Coaching & Consulting. After breaking glass ceilings in the Mortgage & Banking Industry, Christine now is a columnist for professional magazines and is a special correspondent anchoring the news and interviewing experts in her industry. She is an advocate for women, dedicating a complete division in her own company to the cause and communities she touches at a vast level.

Christine spends her days on the national speaking circuit, lecturing on topics focused on sharing her expertise in finance while highlighting her personal stories of inspiration and motivation to deliver both tactical and practical advice. Breaking mainstream in 2019, Christine has appeared on huge stages to speak, kicking off the year at the Miami Garden Stadium with Gary Vaynerchuk Agent2021 as the Real Estate Expert Panel Moderator. Among her many speaking engagements recently, she has spoken at the Anaheim Convention center in Los Angeles, The Hard Rock Casino in Atlantic City, NJ, and for multiple prestigious organizations and media companies.

Christine will tell you that writing, teaching, and speaking are at the core of who she is, and her legacy work she is committed to making a difference in the lives of professionals and youth everywhere.

Christine is a mother, a girlfriend, a daughter, a sister & an aunt, a homemaker, and a lover of laughter, good health, home & heritage. She calls herself a happy human.

Be sure to subscribe to both magazines: The Vision and Women With Vision Magazine. Subscription is FREE and the only way to be sure you won’t miss a single issue of either magazine!

Written by: Laura Brandao

Build it and They Will Come! The Birth of NAMMBA

The spotlight of this column shines today on Certified Mortgage Banker (CMB), Tony Thompson. I had the honor of interviewing two leaders of the National Association of Minority Mortgage Bankers of America (NAMMBA): CEO and Founder, Tony Thompson and Chief Development Officer, Meaghan Heath. Presented here are their bright predictions and initiatives.

Q |

Tony, what was the pivotal moment when you felt there was a missing piece in our industry? |

It all started back in 2011 when I was working on my CMB designation. One of the components of the CMB journey is working with the Mortgage Bankers Association (MBA) and going through a multi-tier education and certification process which includes an oral exam from a peer within the industry who has more than 20 years’ experience. I remember vividly the week I was starting to prepare for this last hurdle of the CMB.

“Tony,” the MBA rep said in a phone call, “We realize you’ve done a phenomenal job through this entire process by yourself, but we need to find an avenue for you to have a sponsor.”

Essentially, in a polite way they were saying, “We’ve been trying to find a sponsor you’ll feel comfortable with, aka another African-American person, but we’ve had a challenge trying to identify someone.” This was the moment I realized being a person of color in the mortgage industry was, in and of itself, considered a minority.

I received my CMB designation, followed soon after by a Future Leaders Award in 2014 and began speaking at industry events. It did not take long for me to notice the lack of women, minorities, and other people of color sharing the stages with me. I know our industry is diverse, but the people on stage clearly did not fully represent our diversity.

A recurring theme became clear to me as I conversed with mortgage and real estate professionals. I heard a strong desire for an organization where women and minorities could come together, irrespective of what segment they worked for within our industry. A secondary, but no less important refrain became clear; we must create opportunity to connect with younger people in our industry and build the pipeline to the next generation of leaders.

This was the genesis of NAMMBA’s birth.

Q |

How did you set up the roadmap for NAMMBA? |

I remember the day clearly. It was back in 2016. I flew to the MBA offices for a meeting with Dave Peterson, the president of the MBA at the time.

“Dave,” I said, “I’m here today because I know one of the MBA’s top priorities is to create more diversity. Every conference I attended over the last two to three years has showed me we absolutely need more diversity, we need more women, and we need more young people. Quite honestly Dave, our industry is not doing enough. I’m starting an association to focus on connecting women and minorities in the industry. It will provide them with training, education, and professional development while focusing on the crucial talent pipeline to connect college students with careers in our industry. I need the MBA to support me and I know we can make this happen.”

Dave was extremely supportive. He reached out to all three real estate and mortgage trade organizations to make it clear NAMMBA was not focused on political advocacy and explained NAMMBA’s mission was purely professional development and training for our existing and future professionals.

By the way, it was about this same time when I met Meghan Heath, our chief development officer. The team was coming together.

The next thing I did was quite a leap of faith. I returned home and while I waited to see what would bloom from the seeds I’d sowed at the MBA, I booked a hotel. I remember telling my wife, “Honey, you’re either going to love me or divorce me because I signed up to sponsor a conference in Atlanta, Georgia next year in 2017. I don’t know how many people are going to register or attend. I must put out a call to action to create this organization and see how many are going to respond.

Our first year in Atlanta, we had 350 people show up from across the county, and the organization took off after the event.

Q |

Tony, tell us about Mission 2025 |

We realized very early on one of the key components of NAMMBA has to be our mission to introduce college students to careers and provide them with financial literacy to help increase the home ownership rate of women, minorities, and millennials over the next decade. Mission 2025 was born as a grassroots effort to connect with college students on and off campuses throughout the entire year. When we formed the NAMMBA foundation we created goals based on a vision to build relationships with 300 plus colleges and universities across the country.

Our industry has many success stories from people who did not come from a college so we recognize a college degree is not necessarily a guarantee of success. What we also know is whether our future leaders come from private schools, state schools, community colleges, or the school of life, Mission 2025 is a decade-long project dedicated to preparing our industry’s future leaders. The first five years focused on several phases:

- Building relationships with colleges and universities over the next five years.

- Adding NAMMBA chapters on college campuses so any student who is interested in a career and wants to know more about our industry can come and listen to speakers and visionaries featured at local colleges and universities. We will be able to engage those students at a local level throughout the entire year.

- The national chapter network of college students will enable us to connect partners to a vast source of talent across the county and help move forward from a diversity standpoint as well as a business standpoint.

The last phase of the program, the last five years, calls for us to take NAMMBA chapters, whether made up of professionals, local chapters, or college chapters, and create a high school club similar to a Junior Achievement or the Future Leaders of America. From 2025 to 2030 the program will focus on high school clubs. Students who are interested and want to learn more can join their high school club and learn about real estate finance. When they go to college, no matter where they go to college, we hope to have a chapter near their school so they can be engaged, can learn more, and can participate in events to land internships, co-ops, and full-time jobs. The outcome will ultimately roll these young learners into NAMMBA as professionals and leaders within the mortgage and real estate industry.

Q |

COVID-19 threw us a curve ball. How have you pivoted to continue NAMMBA and the student challenge while we were in quarantine? |

I honestly believe instead of a curve it has been more like a boomerang shot. We needed to learn how to adapt to a new normal.

We were set this fall to launch our two-year pilot program with six schools in the country to build out local chapters on campuses. Because of COVID, we had to pivot and develop a virtual format for college students and universities. In July we launched the NAMMBA Visionary Ambassador Program to bring mortgage and real estate CEOs and executives together to champion the program.

This is when Laura Brandao reached out to me to ask how she could help. Laura is now serving as the chair of the Visionary Ambassador Program and we have created great momentum. We now have a full virtual format and are committed to holding monthly town halls where we can engage college students by introducing them to our industry. We can spotlight our NAMMBA Ambassadors, CEOs, HR executives, and other industry stakeholders as they share their professional journeys and their insights and advice with them. We show them a thriving industry and the various roles companies play in our industry to begin to connect students to careers within our mortgage and real estate sector.

We are excited about the talent hub we created and launched this summer. It is a one-stop shop providing a high focus on Mission 2025 through a four-pillars format. Originally two pillars, we expanded the concept to add two components in response to the pandemic and the recession we are currently experiencing and the impact it is having on our youth:

Pillar I–Introduce students to careers.

Pillar II–Provide students with financial literacy.

Pillar III–A work-force career development pillar. This is where we teach students how to network, how to find jobs, how to write resumes, and how to write their LinkedIn profiles. These are the skills needed to make them marketable to find a job. We also provide free resume writing services.

Pillar IV–Wellness Training Resources. Last, but not least, acknowledging this pandemic recession has taken a tremendous toll on communities of color, we will provide mental wellness training and resources to these students, offered by the American Psychiatric Association.

Pillar IV came about as we discovered during our research students had packed up and moved home to parents who were impacted negatively, often being laid off because of the recession and pandemic. Think about it. You are in college trying to focus on your studies and instead, while you’re home, you are thinking about how you’re going to pay for next semester, and your mom and dad are at home because one or both of them were laid off. Those scenarios cause a lot of stress and anxiety, which can lead to depression. We want to provide a resource to students to help them find their way and to help provide security and encouragement.

Mental wellness is a key component. These resources are free to our students because of our wonderful sponsors and leaders who are supporting Mission 2025.

Q |

How can all the components of our industry help? |

First, it’s important to understand a bit of history. During the last recession, our industry got a bad name and rightfully so. In this recession, within every community across the country right now we literally have an opportunity to positively impact people of all ethnicities of all backgrounds. Having companies step up to support Mission 2025 is critical to allow us to be able to make available a vast amount of resources to help 50,000 plus kids. There are four million college students who graduated spring 2020. Of those four million, approximately two million are still without a job. Another fifteen million students who are returning to school this fall are looking for co-ops and internships.

Amid this is an opportunity. Our industry is thriving right now, having some of the best year-over-year records. This is a time when we need to make a bet and invest in our future by helping to build Mission 2025. Together we can assure we have a toll highway across America available to converse with these bright young minds and connect them to our industry and our companies. Now is the perfect time to step up; we need companies and leaders to help to support the Mission 2025 initiative.

This is the time our industry has been waiting for, the chance to showcase our ability to be great leaders and build for our future while leaving our legacy. All the data points to more diverse home ownership and more women and communities of color. Our real estate and mortgage professionals need to be there to serve.

Think of it this way. While a toll road is being built, it is a hassle for all who travel in the area. Once the toll road is completed, the ease of being able to by-pass crowded rush hour traffic by taking the toll road erases the memory of building hassles.

Today, I am asking all of us to come together and build that road.

Together we can grow future leaders of our great industry. By preparing our future leaders now, we won’t have a capacity struggle in the near future, which will lead to helping and supporting more families which, I believe, is what we all want.

To become a NAMMBA Visionary please reach out to Meghan Heath at: Meghan.heath@nammba.org.

Laura Brandao is the driving force that has catapulted AFR Wholesale to the top of Manufactured Home and Renovation lending in the USA. She has seamlessly rolled out new products based on market demand, including VA renovation, USDA repair escrow, and One-Time Close construction to permanent loans for FHA, VA, and USDA. Laura’s hands-on approach also propels AFR to remain on the cutting edge of technology with mobile-friendly applications that cohesively integrate the borrower, realtor, broker, and AFR.

This year, Laura has already been featured as one of The 10 Most Influential Businesswomen to Follow in 2020 and among The 20 Most Successful Businesswomen to Watch, 2020 by Insights Success magazine. Laura was among the 50 Best Women in Business named by NJBIZ in 2019, has been recognized as a HousingWire Women of Influence for the last three years, and named one of Mortgage Banking’s Most Powerful Women by National Mortgage Professional. Laura has also been one of Mortgage Professional America’s Hot 100 Mortgage Professionals in 2017, and an Elite Women of Mortgage in 2014, 2016 and again in 2017.

Laura is also actively engaged with a number of organizations and initiatives including the Association of Independent Mortgage Experts and is one of the founders of AIME’s Women’s Mortgage Network (WMN).

Laura also serves as Chair of NAMMBA’s Visionary program, recruiting corporate partners for Mission 2025, launched to introduce, develop, and connect college talent to the industry.

Written by: Ray Befus, Executive Coach

I

f we can agree on anything, it is that 2020 has been a season of unusual stress.

Stress is a feeling of emotional or physical tension. It’s our body’s response to shocking developments, threats, and even unexpected opportunities. In short bursts, stress can be a positive force in our lives. A little stress now and then can wake us up and stir us up to act quickly to avoid danger or to reach meaningful goals.

But chronic stress; stress, day in and day out, over months due to ongoing financial pressures, toxic relationships, isolation, or impossible demands at home or work, can morph into brain fog or even depression. Ongoing stress can drain us of energy, erupt in anger, or evolve into paralyzing anxiety. None of us can afford to let chronic stress become our new normal.

Because we are all different and our challenges are varied, there is not a one-size-fits-all formula for overcoming stress. As a coach, I offer three tools many of my clients find effective in overcoming stress. Let me describe them as:

1) Adopting a positive perspective,

2) Choosing positive priorities,

3) Communicating a positive purpose.

Notice the positivity woven through each one. If you’re a 20/20 Vision student, you might schedule calendar time right now to work through the course, The Power of Positivity.

When we are losing sleep over chronic stress, our perspective gradually narrows, and our moods darken. We may not notice the shift; it can be a slow, subtle change. To continue living our best lives, we must choose and enact specific strategies, day by day, empowering us to remain positive and hopeful.

Positive Perspectives

The first tool to overcome chronic stress is adopting and maintaining a positive perspective. I find myself regularly reminding my clients this is a season, a passage; it’s not permanent, and it’s not forever. I ask my clients, “Who do you know who has overcome similar setbacks, struggles, and stresses?” Others have gone through the same sorts of experiences we are now encountering. They survived their ordeal and they are thriving today.

Regardless of the circumstances—from a cancer diagnosis, to a marriage in crisis, to a loss of income, to overwhelm at work—most clients come up with several names of people they know who have survived an ordeal. I encourage my clients to ask one or two of these individuals out for coffee to share their story and learn the strategies they used to overcome. As you might expect, my clients come back encouraged by these heart-to-heart conversations. What doesn’t kill us really can make us stronger.

Positive perspectives need to be strengthened and maintained by daily self-care disciplines. I’m talking about:

• Physically, it’s important we carefully manage our time and schedule vigorous daily exercise.

• Emotionally, we must own our feelings, cultivate gratitude for what we have, and speak up for what we need and desire.

• Socially, we need to invest in positive relationships, go deeper in our conversations, and firmly maintain our boundaries.

• Spiritually, we can all reduce stress by starting our days with a quiet centering routine: turn off our phones now and then, pause regularly to renew mindfulness, and serve others in need.

For many of my clients, daily self-care disciplines have become their most effective strategy for maintaining positive perspectives.

Opportunity Surrounds Us

Recently, an executive I coach was feeling deeply burdened by the uncertainties, struggles, and losses he was experiencing. When he finally paused in relating his concerns and let out a sigh, I asked him, “What opportunities is this unusually difficult season presenting to you?”

Opportunities? He looked at me like a deer in the headlights. Slowly, he listed a few meaningful opportunities this season was providing him and his team to clarify vision and values, deepen relationships, and pivot to new strategies and processes. I observed his mood change as he shifted his perspective. He now looks back on the conversation as a personal breakthrough. He has experienced a lasting shift in his mindset and his well-being.

The second tool is choosing positive priorities—month by month, week by week, and day by day—whether you’re presently under-challenged or over-extended. I borrowed this tool from Michael Hyatt and his Full Focus planning system. I recommend it to all my clients. Before each month begins, I identify three top priorities which, if I accomplish them in the next 30 days, will make this a great month. I write those down.

I do the same with each week. Before each week starts, I ask myself, “What three top priorities, if I accomplish them, will make this a great week?”

Finally, before each day begins, I write down three big priorities for the day; three priorities which, if I accomplish them will make this an energizing and fulfilling day. Of course, each month, week, and day will include all sorts of opportunities to be distracted and interrupted. But if I stay with the big three, day by day, I can accomplish what matters most and reduce the stress of feeling as though I am just spinning my wheels, moving no closer to my dreams or goals.

Pareto Principle

Is listing three big priorities for each day, week, and month a low bar when there are hundreds of different people and tasks clamoring for my attention? I’m guessing you’ve heard of the Pareto Principle. It is sometimes called the 80/20 rule. Vilfredo Pareto was the first to observe that 80 percent of our results come from 20 percent of our efforts. For example, 80 percent of our sales volume generally comes from 20 percent of our clients. Conversely, 80 percent of our daily busyness often only produces 20 percent of our most valuable outcomes. Yes, it’s true: up to 80 percent of our time is spent on nonessential activities.

Accomplishing each day’s Big Three priorities (while dealing with all the other inevitable stuff that comes up) is enough to turn a season of stress into a season of success.

This discipline of choosing my top priorities for each day before the day begins, means I rarely say or even think, “I have to do this or that.”

Now, day by day as I write down my Big Three priorities, I choose to do what I have decided is most important to me. No one else can tell me what is all important to my life. Only a few things really matter most to me, and when someone tries to tell me I can do it all, I remind myself I can do anything I choose, but I cannot do everything.

Do coaches get stressed? Yes! I’m altogether human like you! But when I practice what I preach, I discipline myself daily to adopt a positive perspective and choose positive priorities.

Communicate Positivity

What’s the third tool I recommend my clients use for overcoming stress? It’s communicating a positive purpose to the people around us, especially when they ask for more of our time than we can afford to give, when they attempt to push past our boundaries, or when they try to pass off their responsibilities to us.

Some of my clients tell me they have a hard time saying No to people who try to pull them into their own agendas. Can anything make it easier for us to say No or at least Not now?

It is much easier to say No to others’ requests, or even demands, when we’ve already said Yes to a solid sense of purpose and priority for our days. And, when we communicate our positive purpose to the people to whom we must say No or Not now, we educate them on who we are and what we’re about. More than that, we model a workstyle showing them how they too can begin to manage and overcome their own stresses.

I am currently working with a woman, a highly paid executive, whose chronic stress evolved into unusual anxiety. She was burned out and chose to leave the work she loved. But after some short-term relief from the stresses of her position, she started to realize she had lost herself and had given up her dreams. In our journey together, she is renewing a positive perspective of herself and her opportunities. She is choosing positive priorities to guide her journey forward, one day at a time. As she communicates with different people in her personal life and in the marketplace, she is forging a positive sense of purpose; informing every Yes and empowering every No. Recently, I told her I believe in her. She’s not working to recover her former self; she’s recreating herself and reinventing the way she will move forward to build her career.

I don’t doubt when you look at your own situation, there may be other causes for your stress and other tools you can use to overcome it. But these three tools: adopting a positive perspective, choosing positive priorities, and communicating a positive purpose, can lift you to a new level of clarity, peace, and energy as we all look toward the next season of our lives.

Ray Befus has spent his entire career in leadership development. He’s folded this lifetime of experience into his coaching enterprise—HIGHPOINT Training and Coaching. He is a member of the International Coaching Federation and now serves as one of 20/20 Vision for Success’ adjunct coaches. In his own work, he continues to provide executive coaching for professionals, business leaders, and their teams both nationally and internationally—helping clients overcome self-doubt, reclaim their best selves, and rise to their next level. Ray lives in Grand Rapids, Michigan where he enjoys life with his wife Carol, four married children and thirteen grandchildren. When he’s not coaching and training, he enjoys motorcycling, playing guitar, and camping.

Written by: Ruth Lee, CMB

O

n August 12th, mortgage bankers on distribution lists across the country received shocking news and every secondary and capital markets’ professional blanched in unison. Numbers were crunched and Zoom meetings were held. This was going to be a hard pill to swallow. With two weeks’ notice there would be no time to make adjustments to rates on loans in the pipeline (i.e., loans already locked or closed). The investor’s letter/bulletin stated, “All refinances delivered into Fannie or Freddie MBS pools with issue dates on or after September 1, 2000, would be assessed an ‘Adverse Market Refinance Fee’ of 0.50 percent (50 BPS).”

Known as a Loan-Level Pricing Adjustment (LLPA), these are usually priced into the rate quoted to the borrower even before they lock. In English, if you’ve refinanced a loan, either locked or closed, it better be at Fannie or Freddie before September 1st or the price will be hit with a one-half point fee.

This was a highly unusual move by the Government Sponsored Enterprises (GSE) issuing a refinance specific LLPA amid a 100-year flood of refinances on short notice leaving mortgage bankers with an entire pipeline priced 50 BPS off. Spoiler alert: It was moved to December 1st, two weeks later.

It is important to understand why this was such a departure from standard operating procedure. While many Americans have been fed a false narrative that mortgage bankers make more money than they can count, the reality is money can always be counted. According to the MBA’s 2019 Annual Mortgage Bankers Performance Report:

“In basis points (BPS), the average production profit (net production income) was 58 BPS in 2019, compared to 14 BPS in 2018. In the first half of 2019, net production income averaged 46 BPS, then rose to 64 BPS in the second half of 2019. Since the inception of MBA’s Annual Performance Report in 2008, net production income by year has averaged 50 BPS ($1,057 per loan).”

Those margins have increased dramatically short term, as mortgage bankers try to stem the tide of refinance volume. For the average secondary and capital markets team, August 12th was a dark day. This surprise announcement would erase a lot of the gains for the year, which many mortgage bankers were relying on to absorb the massive personnel cost increases for overtime, processing, and underwriting. In the end, reason was seen, and the start date extended.

LLPA was first used in April 2008, as Fannie and Freddie found themselves under-capitalized and holding an enormous amount of risk. The Loan-Level Pricing Adjustment was intended to be a mechanism for managing borrower risk, not market risk. The LLPA boils down to a group of fees charged to conventional borrowers for riskier behavior or choices. It is quantified in basis points and assigned to characteristics, such as the borrower’s credit score, loan purpose, occupancy, and number of units. And while the initial adjustment in 2008 was painful, everything in 2008 was painful; in a world of changes, it was just one more.

Over the last decade, LLPAs have afforded Fannie and Freddie an effective way of tuning the dials to charge borrowers for their specific risk without it affecting safer ones. As such, this Adverse Market Refinance Fee is a seeming departure from that philosophy for two reasons.

First, its name is an open tell. Adverse Market Refinance Fee clearly says this is not about the borrower’s choices or behavior. It is about the market.

Second, it includes limited cash-out rate and term, but excludes purchases.

The Significance of Limited Cash-Out Rate and Term While Excluding Purchases

For conventional limited cash-out rate and term, the cash-out moniker can be misleading to those outside the industry. The limited rate and term cash out allows the borrower to refinance their terms, roll in closing costs, and get a de minimis amount of cash (the lesser of $2000 or 2% of the loan amount). Unlike a true cash out, the borrower isn’t really cashing in equity, they are just using equity to pay for closing costs to the table. This product’s risk has long been considered on par with rate terms and purchase money loans.

In this adverse market, it stands to reason you want borrowers with any financial challenges, or even on the bubble, to have the most advantageous mortgage payments. Why? No matter what the media feeds homeowners, foreclosure is bad business. It costs a fortune and everyone loses. It is THE last resort. With a limited cash-out rate and term refinance, a borrower essentially trades their current mortgage with a higher payment and higher interest rate for a more advantageous mortgage with a lower payment and interest rate. The product simply converts a borrower into a better borrower, and it compares strongly with rate-term refinances, FHA streamlines, and VA IRRRLs.

Of note, those government-backed loans are NOT subject to said fee, despite being regulated by the same agency (FHFA.) Perhaps there wasn’t enough political will to face down both the mortgage bankers and the realtors at the same time.

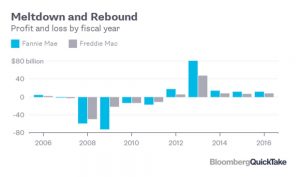

Fannie and Freddie are going to post an estimated $6 billion loss this year. At the same time, FHFA and Dr. Calabria are pushing ahead with plans to release Fannie and Freddie from conservatorship. Guess how much the adverse market fee is due to bring in? Per my back-of-the-napkin math, somewhere close to $6 billion.

Of note, FHA, which is supporting almost double the rate of forbearance as Fannie and Freddie, will have significantly higher losses—and no LLPA.

The end of conservatorship happens when Fannie and Freddie have enough capital to forestall a future bailout. How do you find enough capital? First, rewrite some terms of the bailout to allow the companies to keep more of their profits. Second, tweak the regulations to generate about the size of the capital buffer required. Third, find a good investment banker. Fourth, and finally, see if you can squeeze a thumb onto the scale of the biggest refinance boom in history to ensure losses are covered.

For those not in the weeds on GSE reform, á la the 2008 meltdown, Fannie and Freddie needed a bailout. Due to the risk to the American economy, the U.S. government stepped in to bail them out on the condition of conservatorship and all profits first went to pay off their debt to the American taxpayer (approximately $191 billion) while all the rest, over $100 billion and growing, would do a swan dive right into the debt dumpster of the U.S. Treasury. Previous shareholders were left in the cold fighting for compensation in courts, with some recent successes.

For those not in the weeds on GSE reform, á la the 2008 meltdown, Fannie and Freddie needed a bailout. Due to the risk to the American economy, the U.S. government stepped in to bail them out on the condition of conservatorship and all profits first went to pay off their debt to the American taxpayer (approximately $191 billion) while all the rest, over $100 billion and growing, would do a swan dive right into the debt dumpster of the U.S. Treasury. Previous shareholders were left in the cold fighting for compensation in courts, with some recent successes.

When this is all over, and the losses are accounted, not from the $100 billion in profits sucked into the debt hole of the US Treasury, but from future borrowers, what will the impact be on rates? Perhaps only 10-15 BPS. A thumb on that scale was, in the end, all they really needed.

Getting back to the LLPA, all is well in secondary land as the fee will be priced in for loans delivered as of December 1st.

It does portend two things.

The shift of loans from the GSEs to the government agencies is all but certain. As borrowers find they are priced out of conventional loans, there is a strong possibility they will turn to government loans, which aren’t assessed LLPAs. Specifically, on any loans with lower FICO or multiple units, the path to least resistance will be FHA. Fears continue to simmer in the background from the Brookings Institute paper on liquidity in governmental servicing, as dominated by non-bank lenders.

The second almost assurance? The door is open for the GSEs to turn those levers for any purpose. Does anyone else doubt the expiration of this fee? Perhaps its next name will go right into 1984 as the “Double-Plus Ungood Fee.”

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations and overall business growth. Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Best Practices in Servicing Transfers. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory and legislative changes.

Ms. Lee holds a B.A. in Economics from Mount Holyoke College. She resides in Lakewood, CO with her husband Mike, black lab Ned and two cats, Jefferson and Adams. Winter months find her and Mike riding every peak they can find.

Written by: Rhiannon Bolen, AMP

w

ow! The mortgage industry is incredible right now with record-breaking months, historically low rates, productivity through the roof, advances in automation, and our ability to work from home with no interruptions we would otherwise experience in our office setting!

And yet, I am bored.

Why? Because I’m not a lender and I don’t work with consumers directly.

I am a business-to-business sales professional. This is a prestigious role enabling me to leverage a skillset I have worked hard to develop during my 21-plus years in this industry. The cornerstones of what I do include getting to know customers and future customers, conducting strategic discovery to unearth pain points you can solve, building a tactical sales plan to help progress an enterprise organization through onboarding with a company, supporting various departments along the way, and providing valuable insight to business solutions.

What is the common theme among these skills and services? All are issues lenders don’t have time to undertake right now (even if they’d like to).

I can’t tell you how many times I have had discussions with my business-to-business counterparts, who perhaps aren’t selling an industry-urgent need (for example, warehouse lines, broker/dealers), about the quandary business-to-business sales professionals find ourselves in during this booming market.

Many of us, myself included, have worked entire careers and invested countless dollars and hours developing sales skills, creating structured work days often including 50 percent travel, mastering time blocking, building social media visibility, creating demos, and developing strategic discussions.

We are fast workers and intent on our work throughout the day. Often when in my home office, I barely look up from my computer. Many of us have studied how body language can communicate more than words. I’ve taken so many effective communication classes I can tell right away if you’re a driver or a yellow, or a functional. I match my responses to the way my client communicates with little conscious thought about it. We’ve learned how to make eye contact in a non-threatening way to show we’re listening, then respond accordingly and with relevance.

We have learned how to develop RACI plans for companies we are about to do business with so all parties know who is accountable and can conduct business with relative ease. We are experts at preparing for big industry events and meetings to obtain the most of our companies’ value for their money. I know how to conduct research before I attend events so I can maximize exposure and form initial bonds with folks I run into.

All of these are great skills every enterprise sales professional should learn or currently has, and all have been a challenge to leverage in the age of COVID.

What were once our primary ways to communicate—body language, eye contact, face-to-face interactions, socializing, networking, and building relationships—have come to a screeching halt as travel is denied, conferences are cancelled, and client office visits are not available.

What are we, as business-to-business sales professionals, to do?

It is important to step out of our comfort zones. We must proactively seek ways to gain visibility in a virtual world, shift our way of thinking about how we communicate, and most importantly, remain empathetic and find ways to provide value.

How do we do this? Begin by looking at industry visibility.

How are you currently AND proactively providing value to contacts and colleagues? What does your day look like right now? Are you actively engaging on social media? Do you have a defined schedule for being visible? Do you have days (and even times) you post? Do you know what content to make use of to bring value? Are you actively engaged in LinkedIn groups where your partners and clients are involved? Are you reading articles and sharing valuable info on social platforms?

How about video? Have you tried it? Why not record a couple of videos and save them for posting on a rainy day? I’m sure you’ve seen the statistics about video posts and how they garner three to five times the views over what a regular post would yield.

Are you actively involved in local, state, or national associations? Where can you get involved? How can you volunteer in some way with some association represented in the industry? What about taking the leap with a leadership role within the same vein. This is great for leadership progression and career advancement overall.

Are you aware of the areas where you can impart business-relevant content to the clients you are doing business with or seeking to do business with, and do you have an arsenal of items you can use to draw from?

Do you have an idea of the most pressing issues of importance to your prospective clients because you’ve interviewed your current clients and confirmed what the issues are?

Do you have a list of all the industry partners you can possibly work with? Do you have a regular time you plan to connect with them each month or each quarter? Do you know how YOU can provide THEM with value?

What about within your company? Can you create a focus group? Can you mentor someone? Can you BE mentored by someone?

Do you have areas you WISH you knew more about? Are there places where you can enhance your skillset? Sign up for classes, webinars, workshops or the like and become better at what you do. Enhance YOUR value, both for yourself and for your organization.

Become a Virtual B2B Sales Professional

Remember those mornings driving to the airport at 5:30 a.m.? What can you do with this extra time? Are you working out every day? It’s going to take energy and mental clarity to build your plan to transition to be a visible, virtual B2B sales professional. Thanks to COVID, you have the time, SO DO IT! Take the opportunity to make sure your health is a priority and take pleasure you don’t have to eat your Starbucks oatmeal while running to catch your plane (oh, but you can STILL grab your early morning cold brew, the caffeine will do you good).

This is not the time for the hard sell. This is the age of empathy until we move through this crazy volume. You don’t want to be the sales professional who pushed too hard and turned someone off at a time when they most need support and understanding.

Providing value in times like these and finding unique ways to promote the value you can bring will (eventually) come back to you. People remember. Even if it’s a vague recollection occurring to them sometime in the future, they remember.

At some point in time, it will be appropriate to sell. Until then, it’s important to find ways to be a valuable resource with a genuine desire to support and to create visibility for yourself, your personal brand, and your organization so folks will begin to engage.

Lastly, don’t be too hard on yourself for not having every second of every day over-filled with work. If nothing else, this age of COVID has taught us to slow down and enjoy the simple things. It’s okay. Let yourself have this time. Before you know it, we’ll be back on the road!

Rhiannon Bolen, AMP is known as a trusted advisor in the mortgage industry having served in various capacities in outside, business to business sales and sales management roles for close to 21 years. As an enterprise level sales executive at regional and national levels, Rhiannon’s focus has always been to help support her client’s initiatives and help them navigate through the challenges that lenders face in the mortgage industry. As a previous independent business owner, Rhiannon translated her skill set into the mortgage industry beginning her career in mortgage operations and underwriting, spending a number of years in the Mortgage Insurance space, then spending time managing clients for the largest industry cooperative – Lenders One before finally moving on to join MCT – with a focus on serving clients’ needs around secondary advisory services.

Rhiannon has a passion for industry involvement. She is a board member of the Texas Mortgage Bankers Association and has served as the committee chair for various committees for the past 10 years. Rhiannon is also the founder of the Texas Women Mortgage Bankers Group (or TWMB) – which is a sub-set of the Texas MBA. She is a former President for the Dallas chapter of NAPMW as well as a Past President of the Dallas Mortgage Bankers Association. She was the recipient of the (TMBA) James Wooten scholarship for the MBA Future Leaders Program in 2013 – of which her team was the winner of the program and is on her way to earning her CMB certification with the MBA.

Rhiannon credits her success in sales – which includes various sales achievement awards and accolades – to her consistent desire to grow and learn through participation in sales and sales leadership programs, training and certifications over her career.

Written by: Ana Maria Sanin

Vision (noun) vi·sion |vi-zhən

Thinking about or planning the future with imagination or wisdom. As in, a visionary leader.

W

hat do you think of when you hear the word vision or visionary? I think of possibilities far above reality. We each have the ability to visualize dreams and goals. Even when life is moving at an unthinkably fast pace, and especially when life’s direction has taken an unpleasant turn, take time to embrace your vision and keep it strong. Think of how you want to live, what you look like, and how you want to feel. Vision is limitless because it’s up to us to choose how far it takes us, and how far we can see into our future possibilities.

Vision draws upon and depends on our mindset. Vision is influenced by mindset and is often controlled by whether we are operating in a half-full mindset or a half-empty mindset. The Women With Vision tagline says it clearly, “To Truly See, You Must First Have a Vision.”

I firmly believe in vision. I know the power having vision brings to setting strategy and acting on it. Would you drive a car with a dirty windshield hoping not to hit anything in front of you as you do your best to avoid potholes and pedestrians? Working in a business without a vision to lead the way is like climbing into your car with no destination in mind and leaving destiny in the driver’s seat.

How do we move toward a clear vision if our future seems blurry and quiet? What if we are struggling to foresee our deepest desires? The key is to start from the beginning. Ask the question why. Why am I not seeing my next step? Why are the customers not buying? Why is my business still at the same point it was a year ago?

Don’t stop with the first answer to why. Ask again. Dig a layer deeper and ask why yet again, continuing one layer deeper until our vision clears. Vision can be obscured easily and just as easily revealed when the root of the problem is confronted and addressed, allowing us to again move forward.

In real terms, think about qualifying a client for a home loan. Are you able to visualize the possibilities for the client when you first meet them? Not really. First, we must learn the client’s story by gathering personal information and documents needed to enable us to visualize the possibilities, come up with solutions, and accomplish the client’s desire for a home loan.

The same concept applies to building a brand and building a business around you and what you love to do. When it comes to personal branding and building, or selling in general for that matter, having plenty of vision is the first and most important ingredient. Any business idea originating in our mind starts with a vision. Through our mind’s eye we can imagine the possibilities our business can bring when we put a plan or strategy in place to support the long-term vision.

I started developing my vision ten years ago. It has grown consistently, becoming more visible and solid every time I stop and ask my own why questions. It started for me with a personal journey to seek understanding about myself and led to the creation of a brand. To have a vision of our future and the business we want to build, the work must first start within ourselves.

Any successful man or woman worth admiring started with a vision in mind. Vision lent them strength and courage. Vision enabled them to develop the tough skin needed to push through, no matter how many times they failed. Having a clear vision keeps us motivated and aligned with the vision we want to achieve and bring to life.

Embrace Your Vision and Know What’s Stopping You from Bringing it to Life

Know your purpose. Be in a relationship with yourself. Follow purpose and self-understanding into a vision of your future self. Before you invest in paying an agency to help build your personal brand, do yourself a favor and make sure you are in a space where you are in tune with your desires and the future you want to build for your business and family. Let’s face it, we must be confident in ourselves before anyone else can have confidence in us.

Not sure where to start? Use these questions to help you visualize the future you want for your life. Ask yourself:

- Why do you do the type of work you do?

- Do you have a confident road map leading you to success for your brand and business?

- What is your favorite service to sell?

- What can you do to serve and assist others?

- What do you enjoy the most while working in your space? This is often referred to as your genius zone. What do you love doing and are confident you can do it with your eyes closed?

A benefit that comes from discovering the answer to these questions is identifying your Unique Selling Proposition (USP). Use this knowledge to start building an authentic personal brand.

Remember, your mindset will determine your vision, and your perspective will shift whichever direction you choose. The choice is yours.

Ana Maria Sanin has rocked the nation with her expert branding and has helped professionals take their personal and professional branding to an expert level with great ROI. Today Ana runs her own branding company and is a Master Student of 20/20 VSC. For professionals taking the journey from an unknown Social Media image all the way to monetary conversion, Ana helps identify with who they are and how they are going to get to their very best in this area.

Ana Maria is one of the many incredible Executive Coaches at 20/20 VSC.

MORTGAGE X PODCAST

Being Proactive vs. Reactive to Reach Your Goals

On this episode, founder of Win By Noon, Todd Bookspan, joins Christine Beckwith and Jason Frazier to talk about the importance of executing on being proactive day in and day out to achieve your goals.

Christine Beckwith of 20/20 Vision for Success Coaching and Jason Frazier of Mortgage X Creative bring you the Mortgage X Podcast. Guests range from visionaries working hard to evolve our industry to meet the needs of the modern consumer to the industry’s biggest producers, advocates, legends, thought leaders, partners, and lenders.

What’s a Loan Servicer to Do About Compliance?

Here’s a good overview of the current environment for lenders from HousingWire.

“What’s a lender to do? Today, it’s hard to know with certainty if a servicing operation’s staff are being entirely fair and nondiscriminatory. Behaviors that are discriminatory can be unconscious or occasional, and it can be difficult to detect ongoing patterns or individual cases amidst the large volumes of activity. Forbearance and CARES Act compliance still feels like the Wild West. No models or tools are fully industry accepted—yet.”

The full article can be read here: Article Link

Justice Ruth Bader Ginsburg Dead at 87

This recent headline was universally greeted with sadness. “Our Nation has lost a jurist of historic stature,” said Chief Justice John Roberts. “We at the Supreme Court have lost a cherished colleague. Today we mourn, but with confidence that future generations will remember Ruth Bader Ginsburg as we knew her — a tireless and resolute champion of justice.”

Ginsburg developed a rock star status and was dubbed the Notorious R.B.G. In speaking events across the country before liberal audiences, she was greeted with standing ovations as she spoke about her view of the law, her famed exercise routine, and her often fiery dissents.

There are many links online about her life, death, and legacy. Here’s one from The Guardian: Article Link ;

Most Small Businesses Say They’re Ready for a Coronavirus Spike, Survey Shows

“Seventy-eight percent overall said they feel at least somewhat confident they can handle another surge in Covid-19 cases in the fall and winter, the Comcast Business survey of nearly 600 small and midsize businesses showed. “They’ve been hit hard by the pandemic, but the survey shows there are some bright spots about what the future holds,” said Eileen Diskin, chief marketing officer at Comcast Business.

The Comcast Business survey results contrast somewhat with a similar survey from Verizon Business released Monday. That sample found that 55% of small business owners worry that social distancing will negatively impact their operations, while 67% reported declining sales, though that number was down from 78% in April.”

This is an interesting read from CNBC: Article Link

Home-Price Index Gains the Most Since 2018

Here’s a short blurb, also from HousingWire:

“The S&P CoreLogic Case-Shiller index of home prices in 20 U.S. cities gained 3.9% in July from a year ago, the biggest advance since 2018, as rock-bottom mortgage rates made it possible for people to bid higher for properties. The increase was bigger than the 3.5% advance in the prior month, and it was the largest annual gain since December 2018.

Home-loan rates, measured as a weekly average by Freddie Mac, have set new lows nine times since March when the Federal Reserve began buying mortgage-backed securities to keep credit from freezing amid the worst pandemic in more than a century. The rate was 2.9% last week, Freddie Mac said on Thursday. It was the ninth consecutive week the rate was under 3%.

“An unprecedented lack of for-sale homes combined with persistently low mortgage rates have stoked a competition for housing in recent months that will not relent,” said Matthew Speakman, a Zillow economist. “With mortgage rates poised to remain low for the near future, barring a sudden surge in inventory, it appears that upward price pressures should endure into the fall.”

Phoenix posted the biggest price gain, up 9.2% from a year ago, followed by Seattle, at 7%, and Charlotte at 6%, the report said. The smallest gain was in Chicago, up 0.8%, followed by New York, at 1.3%, and San Francisco, at 2.5%.

Home sales in the U.S. surged to a 14-year high of 6 million at an annualized pace in August, the National Association of Realtors said in a report last week.

The number of properties on the market at the end of August totaled 1.49 million, down 18.6% from the year-ago month, the report said.

Unsold inventory measured as a “months supply” number that gauges how long it would take to sell all the homes if nothing else came on the market, was three months, NAR said. Economists typically consider a four- to six-month supply to be a balanced market, with equal demand from buyers and sellers.”

When I’m thinking about branding, Superman really was one of the best branders out there.

Learn how Vonk Digital can help you leverage the New Way to build your brand, authority, and credibility with our website platform and tools. Visit us at www.vonkdigital.com

Read this vlog episode, if you prefer, on the Vonk Digital blog!

Vonk Digital, an industry leader in website and marketing tools for mortgage originators across America, is a proud sponsor and hosting partner of The Vision Magazine.

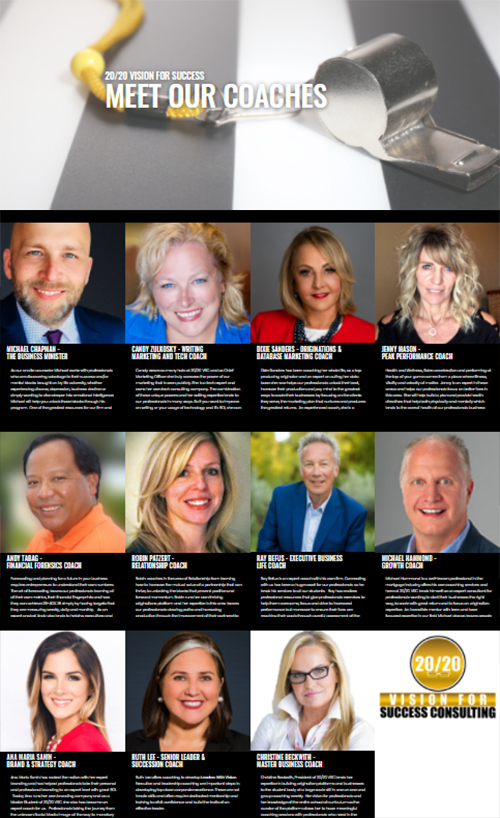

20/20 VISION FOR SUCCESS COACHING

Have you checked out the 20/20 VSC website lately? Our dynamic, talented, and experienced coaches have their own page! Visit www.visionyoursuccess.net/coaches to read all about this amazing team.

The words 20/20 Vision for Success are not in the name of this company by accident. Coaching is about building a foundation for results and knowing how to step into action based on that foundation. Turning vision into reality requires trust that the bedrock beneath the vision is sound. Coaching with 20/20 Vision begins by building and strengthening your foundation and ensures that, as coaching progresses, you and the 20/20 team behind you remain focused on the vision for success.

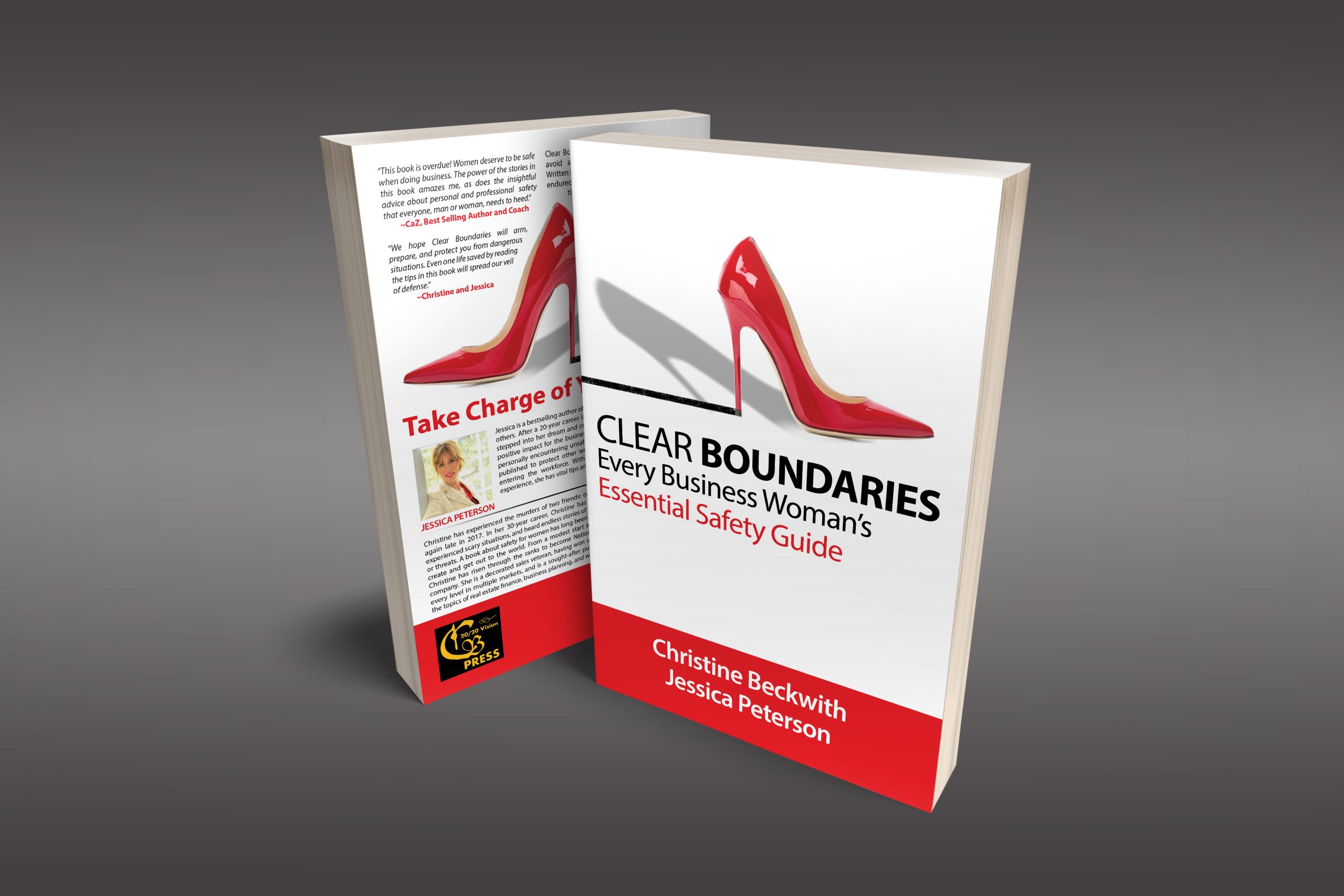

September was realtor safety month. Now that the events and courses are over, take time to review and learn more about staying safe in today’s business environment. Clear Boundaries: Every Business Woman’s Essential Safety Guide was born out of the shared experiences of Beckwith and co-author Jessica Peterson who have traveled across the country for business. Sadly, both have firsthand knowledge of how dangerous it can be for a woman. The authors draw from their experiences and call upon experts to present real, actionable, and practical advice to prepare anyone to avoid and survive what could be a dangerous scenario.

RECOMMENDED READING

Be sure to catch thes other great reads from Christine Beckwith. Feel free to go grab them now on Amazon!

Breaking the Cycle is filled with engaging stories wrapped around a theme of power words and is an invaluable treasure trove of practical, hands-on advice. Jam-packed with easy-to-implement suggestions, you’ll read sage advice from two women whose diverse career paths literally write the book on how to create your version of success!

In Wise Eyes: See Your Way to Success, Beckwith tells her life story in a style that is real and raw, but brutally honest. Wise Eyes is a handbook for professionals wanting to walk a direct path to incredible success.