Bob Mohrhusen

“People don’t care how much you know until they know how much you care.”

As the close of another year looms, it is both a time of reflection and a preparation for the new year amid the hustle and bustle of the holiday season. We wish you and yours all the best in the coming year. We hope you find great success coming from lessons learned and new ideas embraced. We wish health and happiness to all.

We are grateful for the support of you, our readers. And as always, offer a big Thank You to all who subscribe to and advertise in both magazines.

I hope you enjoy today’s issue and will share www.TheVisionMag.com in social media. Reach out and congratulate your peers whose bylines and profiles appear in these pages. Tag us in your posts #thevisionmag and #2020visionforsuccesscoaching. We love the feedback!

Candy Zulkosky

magazine@visionyoursuccess.net

Dear readers,

As we wrap up 2022, I am amazed at how fast this year passed. We entered the year with much hope and challenge, and we leave the year with much hope and challenge. In between, I have had the honor of seeing many professionals working diligently on solving the market changes. I have also been proud of the 2020 Vision Coaching staff, who have risen in the face of the market changes to bring pertinent curriculum in a time of need.

I would be remiss if I didn’t pause to pay tribute to Bob Droysen, one of 2020 Vision’s amazing Student Advisors who, unfortunately, was fatally wounded in a bicycle accident in October. Bob’s absence and loss have profoundly affected all of us; he is deeply missed by our staff and his surviving significant other, Candy Zulkosky, our Chief Marketing and Operations Officer. We will forever remember Bob’s smile, humor, hard work, and heart.

And to my family who lost my older sister in September, tragically after a long battle with many illnesses. “Let us carry her memory forward, her sarcastic sense of humor, her curiosity of the world, her tenacity on politics and medical matters she felt cause worthy. Let us honor her by repurposing our pain in productive places so the world can benefit. She will forever be missed but not forgotten.”

I end by saying that despite sadness and tragedy, tough markets and challenges, I see our lives’ endless silver linings and blessings. When you tip your glass on the eve of the New Year, remember you are a survivor and find the blessings that await. Work hard in 2023 to solve to your personal goals and for now, til then, take time to breathe in what matters in life: love, family, making memories, and experiences.

Happy Holidays and Happy New Year!

info@visionyoursuccess.net

WRITE FOR US

Yes, we do accept submissions. If you are a writer interested in being featured in a national publication, we will be happy to consider your ideas and your article submissions. We are also interested in recurring columns centered around our featured topics. The place to start is by clicking the button and inquiring.

DO GOOD AND FORGET

Written by CaZ

The Elite Team at AnnieMac. Most would count this as a great name for a mortgage business, and they would be right; it’s a great name and describes a successful team. But it’s not what most people think of when the name Mohrhusen is mentioned. According to Bob Mohrhusen, “Everybody knows us as Bob and Becky. We’ve built a good thing. We have a great system. Becky is my wife and my boss and my business partner, and it all works well.”

Living a blended life is not new to Bob and Becky. When Robert Mohrhusen and Rebecca Amos met, mortgage was not a part of either of their worlds. Both were highly successful leaders in the food services industry: Bob, a corporate executive in charge of the sales force, and Becky, a marketing director. When they married, Becky chose their blended family over her ten-year-old career and left food services to reach for a career in a different field, eventually finding success in mortgage.

“After we married 10 years ago, Becky moved around a bit, career-wise, and then decided to bring her crazy marketing mind to the vanilla world of mortgage. She built an unbelievable brand and recognition in the mortgage industry. Six years ago, I left a 25-year sales career in corporate America to join my bride in mortgage. Together we make a winning team. We’re all about people. She has the creative mind, and I can build relationships. The rest is history.”

Career partners and family partners, the Mohrhusens have raised their four children together, navigating all the typical challenges of siblings shuffling between parenting households.

“We have a blended family,” Bob says. “Peyton Anne is a recent graduate of James Madison University and working in marketing and social media. Lauren is in her Senior year at Longwood in the Nursing Program. Payton Riley is a Sophomore at Christopher Newport University. Nathan is a Junior in High School and is ready to take boys’ volleyball to the next level.”

And yes, there are two siblings named Payton and Peyton. Life has a sense of humor at times as son Nathan is dating another Payton.

“We had all three of them together last night,” Bob continues. “My oldest is twenty-four now, and she came over for dinner along with her sister and Nathan. Then Payton Riley came home from college, so it was good to have all the kids there.”

The Mohrhusen clan enjoys travel, spending time with good friends, enjoying good food and wine, and, most of all, they enjoy their time together. There are unique challenges when a husband and wife work together. Being in each other’s pockets 24-7 can add stress or can be exceptionally rewarding. For Bob, it’s the latter.

“To break the monotony of home and work, I go to the gym, or she goes to the gym, or she does her walking in the morning. Really, we’re pretty much together all the time. Even when we travel, and we love to travel. St. John in the Virgin Islands is one of our special places. With the kids, it used to be Disney, but for the two of us, blue water is usually where we end up. We’d rather go to the beach and relax and enjoy our time together.”

For Bob, the walls between family, daily life, and career are thin indeed. In his ‘spare’ time, he is active in the community, sitting on several charitable, service, and business boards and councils, and was recently named to the Chesapeake Planning Commission. He is not kidding when he says he’s active in the community. Here are some of the other boards and councils he serves on: Chesapeake Boys and Girls Club, Chesapeake Rotary, Chesapeake Wine Classic, Chesapeake Regional Hospital Foundation Board, Chesapeake Regional Hospital executive committee, Chesapeake Regional Hospital Gala Committee, Hampton Roads Realtors Association Executive Board, Hampton Roads Realtors Association Affiliates Chair, and Chesapeake Redevelopment and Housing Authority,

“So, I’m a City Commissioner now. I stay busy, and active, and do good and forget. A lot of people pay for business. They pay for leads. Becky and I don’t do that. We provide our value with relationships. We make sure when we get a referral from an agent that the client will get the best experience. Most of the agents we’ve partnered with are our true partners who also want to give every client the best experience they can. That’s what we always do. We treat people right. My grandmother always said, ‘Do good and forget, and it plays out.’”

Bob’s grandmother is a strong role model in his life. He counts himself as successful, not necessarily by monetary measures. Rather success to him is having past colleagues and clients who recognize him and stay in touch. Bob values being looked up to as a mentor or expert. He believes hard work, hard play, and practicing skills are the actions that lead to success.

“I see people with strong relationships and hustle winning this battle! Hustle beats talent when talent doesn’t hustle. Get out and talk, but don’t talk doom and gloom. Don’t focus on the rate. People can still buy houses. Marry the house, date the rate.

People laugh when I say that, but it’s true. The key is to find the right house. We help people understand you buy a house; you build a home.

And right now is a great time to buy a house. There’s less competition for the house you want. In the spring, when the rates come down and inventory goes up, you’ll be in a shark frenzy of multiple offers and no closing costs. Take advantage of this time to buy the right house. The rate can change, and there’s always a refinance. We just want people to have a great positive experience.”

Bob is a do-as-I-do leader. He does not expect anyone to do what he has not or would not do. His favorite part of the mortgage industry is the relationships and helping people with their biggest financial investment. He believes in people, saying, “When you do right by people, they will continue to love, trust, and respect you.”

Even the tips Bob offers for success resonate with his core philosophy:

- Do good and forget.

- Listen. Underpromise and over-deliver on the details of what is important to that person.

- You have one chance to make a first impression, make it memorable.

“My grandmother always said, ‘do good and forget.’ That has resonated in many aspects of my life. I just do the right thing by people and don’t expect anything back. And good things happen. People don’t care how much you know until they know how much you care.”

“I’m a connector of people. What we do comes back to us. It’s really simple. Be good. Just be good to people.”

It’s a worthy philosophy and the guide by which Bob Mohrhusen lives.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor in chief of this publication.

As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with.

On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the best seller lists!

CaZ is pronounced KayZee in case you were wondering.

Faith Schwartz

SUPERPOWER? Stay True To Your Principles!

Faith Schwartz clearly embodies the term Class Act. She has traveled far from her roots in small-town northeastern Pennsylvania to become a nationally recognized and respected leader and expert in housing finance. Schwartz has played a firsthand role in shaping industry best practices and policy during her exemplary career. Her list of awards and accomplishments is long and demonstrates a history of partnership and service to both the industry and the consumers we support.

“I contemplate a housing environment where everyone has the opportunity to participate, create generational wealth, and make the world a better place for those to come. We are not there yet. It is my purpose and intent to work with industry and political leaders to move the ball forward. It is incumbent upon our generation to make a difference for those who follow.

Mortgage is my career and I am blessed for it. Helping others achieve the dream of homeownership is a true calling. I did not know, when I started some 30-years back in the capital markets for Dominion Bankshares Mortgage Corporation, I was embarking on a career to make a difference for others through housing finance.

My early start in the business led me through the entire mortgage lifecycle to become an influencer of the important public policy surrounding homeownership and the creation of generational wealth. Each aspect of mortgage can be improved and modernized. Innovation opportunities remain and I am fortunate to provide insightful thought and analytical guidance to the future state.”

Faith is recognized as a pragmatic visionary who excels and is able to apply proven business principles in new and innovative spaces. She is a decisive leader who demonstrates a strong EQ and understanding of the room, the leaders, and the stakeholders to reach and customize solutions.

“Even as a focused leader, I enjoy having fun along the way. I grew up in the mortgage business, starting with the capital markets and COO oversight roles. I take my long history in the mortgage business seriously and have learned a great deal about operating through many cycles.

I have been the only woman in the room for a long time and while that is less true today, it still happens. I think my strength as a leader is being confident and comfortable in my own skin while staying authentic to the facts and issues I speak about and staying respectful to the diverse array of opinions.

Faith’s favorite part of her work is people. Having begun in secondary marketing to securitize production and buy and sell mortgages, the networks she’s created remain alive and well today even decades later. “In this business,” Schwartz shared, “We were always great friends, no matter how fiercely we competed. I find the camaraderie contagious and continue to stay connected to hundreds, perhaps thousands of individuals I have met in my career. It is unique, fun, and hard to give up!”

It is clear Faith Schwartz loves and is committed to her career. Yet she values family even more saying, “Hands down, my greatest success is my family. My marriage and three wonderful children bring me great joy and represent far and away my greatest accomplishment. My husband, Erich Schwartz, and I met at the 9:30 Club in Washington, DC years ago and were married in 1992 a few years later. Erich is recently retired and now teaching in the law school part time at UT Austin. We split our time among DC, MD, and TX.

We have three children, Erich Jr., Katherine, and Jack. They are all in their 20s and gainfully employed. We raised the kids in Washington DC, traveled a great deal to have family time, and are close knit as a family. There are 23 first cousins in the family so we have a lot of weddings we are starting to attend!

As challenging as it is, I strive to have a happy, healthy family with a balanced work life. In this way, I seek to enjoy life and offer help to those in need, and those who are less fortunate or need a helping hand.

I endeavor to be a life-long learner. For example, COVID-19 taught me I can be productive without being on planes 24/7. In my opinion, companies that do not recognize this seismic shift in migration and the workforce may be at risk of losing their resources.”

And with this, the conversation with Faith returned to the passion that takes second place only to family,

“I founded Housing Finance Strategies (www.housingfinancestrategies.com) to deliver quality and make a difference in the future of housing finance; to raise the bar on professional advisory services with an emphasis on mortgage modernization and inclusive policymaking. For my company to be successful, we have to live my values and deliver quality performance. We have made good strides in executing my plans, but we have unfinished business. I expect Housing Finance Strategies to be synonymous with outperforming expectations, being known as the ‘go-to’ advisors in mortgage and possessing extraordinary talent.

I cannot envision a point in time when I step away from the mortgage industry. It is my intention for Housing Finance Strategies to leave an indelible mark on our future. We advocate and pioneer mortgage modernization efforts, and we keep a close eye on the consumer because this is where our business starts and ends.”

Our discussion expanded to explore where the industry is headed in the foreseeable future.

“I think we will continue to see further consolidation given the dramatic shift in volumes and purchase money business. With limited housing stock, I do not see the business thriving without finding more solutions for the affordable first-time homebuyer programs. Tech will continue to evolve the business, finding new ways to qualify borrowers.

Capital is king and the companies that figure out the end-to-end solutions coupled with attention to data privacy, consumer accessibility, and usage will be the companies that thrive in the future. More brick-and-mortar focused organizations will be at some risk, in my opinion, of losing traditional customers who start to evolve into a digital solution. Many companies may get caught flat footed in this area. Customer acquisition and cost containment will be a big focus in the coming years.

While no one likes to compete on price alone, good reputations are not enough to meet the requirements of customer acquisition which is often online. None of my children write checks, for instance. The Millennials are driving purchases and they are used to Amazon!”

Everything about Faith Schwartz is a Class Act. Our conversation turned to fintech and the future of technology solutions in the industry.

“On appraisal, I see a fully digital process though we continue to lag in the valuation space in integrating 3-D scanning on all homes. We need to incorporate on-site 3-D scanning for the digital footprint, condition of property, and views from each room. I see independent staff conducting this inspection with advanced nimble technology, driving the information to a desk appraisal or hybrid appraisal which will scale the offerings.

With the modernization of mortgage lending, I envision getting to source data sets, normalizing the data, and appending it to consumer digital data sets. These steps will enable a very strong and stable mortgage industry. By creating digital identity, income, asset, employment, trended credit, and digital valuation leveraging AVM’s, 3-D scanning, and E notary and closing, I see blockchain and ledger technology leading the way for the future in mortgage.

This capability will wring out inefficient expenses and offer much more certainty in mortgage lending leveraging standard uniform data sets. While the capabilities are all here, harnessing and leveraging this information is going to coincide with regulatory and investor guidelines and over time, this should continue to evolve.

Given the remarkable focus on Valuation Bias in the system, this will strengthen the hand of lenders, investors, and appraisers who need to work objectively across the industry as decisions are made on valuation. The 3-D digital scan of the property, inside pictures, and views from all windows, should be part of all property footprints. This represents progress in our industry and we will get there one day!

I have been delighted to be a board member and advisor to Class Valuation as it continues to evolve its business model as an AMC. The education around their business and advancements through technology fits in nicely with my policy orientation and modernization of the mortgage business. As someone who loves the business, one of the goals has been to decrease the cost of origination and loan servicing. I see this technology as part of that solution for the consumer, lender, and downstream investor. Class is a leader in property tech and is leading the way in innovation in this space. They think deeply about their customers, the clients, the appraisers, and the policy issues around what it means to be an AMC. It is a privilege to be part of the Class family.”

“Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has.”

Schwartz considers this quote from Margaret Mead to be a guide by which she and others are reminded to be respectful of others and how important it is to gather opinions and input to harness the ideas to help fine-tune your institution or product offering to drive business.

“I enjoy bringing diverse sets of people together to find some common themes to move an issue forward. And I am fortunate to have lived this quote through my work as Director of the HOPE NOW Alliance.

Professionally, I will always treasure the challenging work of leading the industry out of the housing crash of 2007 as the Director of the HOPE NOW Alliance. It was a career inflection point as many moved on from what quickly became a troubled industry. And I felt the tension among all of the players from government leaders to mortgage company executives to troubled homeowners at risk of foreclosure. The acrimony and finger-pointing on all sides rose to a fever pitch but slowly and carefully we were able to slowly course-correct by directing all of our efforts to sustaining homeownership.

As Director of HOPE NOW, I traveled to the communities most impacted by the crisis and met with at-risk homeowners. I led the team in organizing around the federal government, nonprofits, and advocacy groups to ensure there was protection and a trusted third party for borrowers to have at their side when meeting on their loan workouts. We developed a new waterfall on modifications with the help and support of the FHFA, GSEs, and Treasury. We developed datasets on performance and made them available to the public and Congress in an effort to transparently report on progress or shortfalls.

The coordination and communication that was required on behalf of the industry was significant and key to any successes we had. For all participants, leadership was necessary at all levels of a company, non-profit counseling agencies, and government agencies. The spotlight was always on and developing a path forward with many disparate parties was challenging but also rewarding.

Faith Schwartz has an amazing clarity around her purpose and vision. Hers is a vision both being shared and implemented. It is fitting that hers are the final words in this article, words which clearly share the heart of her vision.

“Focus, focus, focus on execution. The greatest business lesson comes from how I think about success. In any project, I analyze the opportunity and choose three-to-five focus areas and visualize the steps to get them done. All the while, I do what I say I will do: stay transparent, deliver best-in-class reporting, and communicate well.”

Faith Schwartz- Founder and Principal at Housing Finance Strategies

Faith’s Advice and Tips for Success:

- We all take left turns and nothing is perfect so take a deep breath.

- Assess your surroundings and adapt to the culture while you grow and mature in your role. By creating your own principles on how you carry yourself you will stay above the fray when it comes to chaotic leadership.

- Working for strong and talented leaders is a treat. Find something you like about your leader so when you have a conflict, you do not make it personal.

- Always raise your hand or say yes to requests that may be interesting, helpful to the organization.

- Make sure the leadership and your colleagues know you are there to be helpful and like to lead.

- Be your authentic self.

- Learn from everyone around you, up and down and sideways.

“I do my homework and speak about issues I am close to. I have learned a great deal from the emerging growth companies that remain innovative, yet I maintain my guiding principles of how to run a successful company:

- Hire the right people, they are your best asset

- Don’t hire yes men or women

- Strive for operational excellence, you owe it to your clients and customers

- Lead with strong morals and ethics

- Maintain confidentiality

- Give people a chance, believe in them

- Be Trustworthy

- Acknowledge mistakes

- Share often and broadly any new learnings

- Help others along the way, never say no to a request to meet if someone is looking for a job

- Speak up

- Ask for what you want.”

With age comes wisdom is a commonly used phrase. When I was young, I thought I was wise and understood wisdom. Time has shown that I, as is true of many people, did not have a full understanding of the meaning of the word wise. Wisdom is about the experience, not intelligence. And wisdom is what separates the pack in this season of survival for the mortgage industry.

Do I have your attention? Then you will want to grab a pen and notepad. What I am about to say could yield millions of dollars in return. The trick here is the application.

First, without reciting my resume, let me share a few key points. I moved up in the industry through origination to holding a national rank after spending years in the branch, district, regional, and national sales positions, not in marketing or training, business development, or operations. Even though those departments were places I spent hundreds of hours meeting and collaborating with, I was a true-blue sales leader.

Why does this matter? Because I served from ‘88 to 2018 directly in the field, riding against the low and high tides of the market. I learned a keen understanding of Wall Street flux and the margin call environment, as well as elected official policy influx like Obama’s reduction of the mortgage insurance premium during his legacy months exiting the White House which sent the American banking industry in a 40 percent surge of FHA refinance.

I also watched the first round of high deficiency hit in the fall of ‘98 when investors first yielded to buying the new, higher-rate portfolios. I remember banks loudly and publicly vocalizing this was a sign of evil done by newer subprime lenders. Large banks had not opened their subprime channels yet, and the divide was prevalent. In reality, we haven’t come far from those days, as leaders from both sides water the divide.

And still, with rising rate environments I rose to my highest rank up to that time as SVP of sales for H&R Block Mortgage, only to watch its complete consolidation at the start of the ‘07 demise. I lost my job while staying until the bitter end to shut the lights off.

Starting over was difficult tactically and mentally. Still, I found a safe haven and rose to ride again for 12 years with AnnieMac Home Mortgage holding at first an area manager position in the northeast and soon becoming their National VP of Sales & Realtor Development. I exited in 2018 to build 20/20 Vision for Success Coaching.

Serving as a consultant now during this current season, I find I draw upon WISDOM gained across decades of experience. I truly understand the effects and the challenges for individuals serving in the industry and those trying to navigate the complicated waters from the helm of their ships. It is a painful storm to weather and my advice will be lifesaving to many organizations and professionals.

So let me break it down for you quickly:

- What the market is experiencing now is not ‘07 and ‘08.

Back then, we were in a high delinquency, low demand market, and the guidelines were too aggressive to protect against the storm, causing mortgage delinquency to rise to a level of default and sending investors into a tailspin that ultimately was the complete recipe for disaster.

Today you have low delinquency and high demand. Homes HAVE equity. Investors are protected against good policy and guidelines today, so we will not see a repeat of the likes of ‘07. However, the rising interest rate reaction we see right now is sending originators into a panic, the likes of ‘07 and ‘08, and we have all forgotten how to sell in a traditional market where the rate is not the prevailing worm on the line, so to speak. As such, executives are making fatal mistakes focusing all their energy on consolidation rather than wrenching the sales towels dry of activities that keep the troops focused on HOW TO FISH AGAIN.

Seems dumb. But is oh so true. By way of calculating and testing this theory, I took fifty top originators in November of 2021 and began teaching them these selling techniques from a tactical standpoint to a practical marketing application. Voila, they are all doing high levels of volume compared to their counterparts and approximately 60 percent of their volume from prior years month over month, compared to the plummeting of their peers to 25 percent or worse of their prior volume positions. This is the difference between life and death for organizations right now.

Leaders can’t lead through this. We have to learn and teach how to navigate a changed mortgage world. I am seeing with great intelligence some are in defensive positions, in the throes of laying off personnel, and not developing their sales force which is struggling to remember what mortgage expertise looks like.

- Fishing is not hard right now; it’s just different.

It’s easy to get your phone to ring right now. It takes understanding the mentality of the homeowner sitting on a low market interest rate they received in the prior two-to-three years.

The loan originator needs to BELIEVE there is value in providing more than a low-interest rate. Teaching the loan originator to believe in the value is harder to navigate than you would think. The loan originators, by and large, don’t believe it. Many of them came into the market in the last three years and have yet to serve in a normal market. It’s a shame. It’s psychological warfare for companies.

Test the troops’ knowledge. Ensure they are current with performing a mortgage analysis in this market, considering all options including high equity, debt (interest rate of that debt), and cash-out refinance ability.

LOs’ marketing must be loud and consistent and aimed at convincing homeowners to call for a FREE mortgage analysis.

Understanding homeowners won’t want to change their rate (because this is the inept reality of their knowledge about mortgage refinancing) is going to require true blue, honest-to-goodness guys and gals. They’ll need to explain the benefits of grabbing equity to cure debt or invest in their futures, doing what is SMART, and doing what the wealthiest do.

Mortgage pros who need help understanding expert advice provisions for homeowners should be offered wealth-building classes.

Relying on purchase business is a dying man’s philosophy right now. Some originators still have this business coming in, and percentages show they are surviving. But telling a starving LO or company to focus here for survival if they’re not already fluent in purchases is the long walk off the plank.

- Mortgage pros should use this slower time to fortify their realtor relationships.

- Mortgage pros should seek to purchase a business.

- Mortgage pros need to fish for cash-out refinance and believe it can be 50 percent of their business with a 60–90-day focus.

- Companies need to bring in professionals if they need to educate their troops. (That may seem self-serving, but it’s the truth). During my tenure in national positions, I hired coaches, many of whom have been my competitors for years. They all know me, and they know I believe in this.

- Digital Marketing Expertise

Mortgage pros need to have strong messaging, believable messaging, and a strong call to action with it.

By and large, mortgage pros aren’t converting on social media. They miss crucial and subtle points in their messaging, and they do not know how to do it as consistently and persistently as needed.

The prior mentioned philosophies need to be in every weekly sales meeting until sales troops’ volumes rise. Reread 1-3 again.

‘Tis the Season of Survival and while I would have loved to write you all a fluff piece wishing you the happiest of holidays which of course I do wish for each of you, right now, we need to make haste.

I am grateful for an incredible year. While I navigate this storm along with all of us in the industry, I am also taking my own advice and doubling down on sales focus with a laser-focused message about what I know is needed right now.

I am grateful for everyone who has stopped to read this article or our content on social media, and for everyone who has bought our programs and participated with us in our events. I am grateful for my team here at 20/20 Vision, who carry my torches and vision of the future of consulting and have ridden alongside me building and working really hard.

I am grateful for all I have and for all the souls we are responsible for. I am also very much pulled into the war of this industry as a seasoned leader wanting to make a true difference, and you will find me in 2023 at the helm of a large pulpit delivering life-saving sermons to those willing to hear the message. I hope it will deliver incredible results at a time when people need a map to dry land where they can learn we will be ok in this storm if we keep fishing, and more importantly, with the right bait. There is much time wasted right now; crucial time we do not have to squander.

Christine “Buffy” Beckwith is an award-winning executive sales leader who has spent the past 30 years in the mortgage finance industry. Her life and career are filled with a progression of success stories reaching all the way back to her childhood. A Best Selling and Award-Winning Author, Christine branched out in 2018 to begin her dream job as the founder and president of 20/20 Vision for Success Coaching & Consulting. After breaking glass ceilings in the mortgage and banking industry, Christine is now a columnist for professional magazines and is a special correspondent anchoring the news and interviewing experts in her industry. She is an advocate for women, dedicating a complete division in her own company to the cause and communities she touches at a vast level.

Christine “Buffy” Beckwith is an award-winning executive sales leader who has spent the past 30 years in the mortgage finance industry. Her life and career are filled with a progression of success stories reaching all the way back to her childhood. A Best Selling and Award-Winning Author, Christine branched out in 2018 to begin her dream job as the founder and president of 20/20 Vision for Success Coaching & Consulting. After breaking glass ceilings in the mortgage and banking industry, Christine is now a columnist for professional magazines and is a special correspondent anchoring the news and interviewing experts in her industry. She is an advocate for women, dedicating a complete division in her own company to the cause and communities she touches at a vast level.

Christine spends her days on the national speaking circuit, lecturing on topics focused on sharing her expertise in finance while highlighting her personal stories of inspiration and motivation to deliver both tactical and practical advice. Breaking mainstream in 2019, Christine has appeared on huge stages to speak, kicking off the year at the Miami Garden Stadium with Gary Vaynerchuk Agent2021 as the real estate expert panel moderator. Among her many speaking engagements recently, she has spoken at the Anaheim Convention center in Los Angeles, The Hard Rock Casino in Atlantic City, NJ, and for multiple prestigious organizations and media companies.

Christine will tell you writing, teaching, and speaking are at the core of who she is, and her legacy work she is committed to making a difference in the lives of professionals and youth everywhere.

Christine is a mother, a girlfriend, a daughter, a sister, an aunt, a homemaker, and a lover of laughter, good health, home and heritage. She calls herself a happy human.

Written by: Jenny Mason

Here’s to you, give yourself a high five; you have crushed one tough year and proven to yourself once more it’s not what you face but it’s what’s inside of you, and that, my friend, is greatness, so cheers to you!

As we prepare to embark on a new year, making goals and plans, I hope this is one of your most successful ones yet. What does success look like to you? Success is much more than wealth or possessions. We’ve all heard countless stories of seemingly successful people who were miserable, so maybe success is finding fulfillment, once you’ve tasted significance, success just doesn’t taste quite the same.

The dictionary defines success as, “the accomplishment of an aim or purpose.” John Maxwell said, “Success is… knowing your purpose in life, growing to reach your maximum potential, and sowing seeds that benefit others.”

Success is not what someone else or the world deems it is for you; it is how you define it. What is your aim? What is your purpose? What do you want? What would bring you fulfillment? What are your gifts? The exciting thing is you are the one to decide what success is to you and design a blueprint for it! Clarity is key; the clearer you are on the answers to these questions, the easier it is to take the actionable steps to achieve your desired success.

Once deciding your aim, purpose, wants, dreams, and definition of success, ask yourself questions to help you stay motivated. The root of motivation is motive, and the “ation” is action. We need the motive to make the changes we need to make, take action, and find motivation on those days we aren’t. When circumstances become challenging, reflect on what caused you to pursue success in the first place. Your goals need to be like magnets. They need to draw you and inspire you. Steve Jobs once said, “passion is the key to success.” Without passion, you will give up when you run into a roadblock or face some difficulties on your journey.

“First, you fuel the desire, then the desire will fuel you.” ~Napoleon Hill

How will achieving this make you feel? How will your life be different? How will this impact the lives of those around you? How will it feel if you don’t? What would the consequences be?

Another key on your journey is to exterminate the ANTS, the Automatic Negative Thoughts, and the limiting beliefs that keep holding you back. A method I learned from Dr. Amen is to ask yourself, Is this thought true? Is it 100 percent beyond a shadow of a doubt true? Most times, it’s not. How do you feel when you think this thought? How would you feel if you no longer considered the negative thought? Now turn the view into the complete opposite. So, for example, let’s say the thought is, “Nothing ever works out for me.” Is it true? Maybe sometimes, but is it every single time? No. I don’t feel discouraged when I think about it and if I didn’t think about it, I would feel liberated, so I will say, “Everything will work out for me.” If we truly knew the power of our minds, we would be much more careful about our thoughts and what we speak to ourselves.

Now it’s time to take action, determined action, no matter how small the action is, take it. Do one thing to move you closer to where you want to be and whom you want to become, and make your tasks into manageable actionable goals, then celebrate those actions. At the end of each day, go over what went well today and what you would like to do well tomorrow. Go to sleep with positive affirmations and wake up with positive expectancy. If you continually focus on what didn’t go right and what you didn’t complete, you are self-sabotaging and setting yourself up for defeat. You will have a restless sleep, feel beat down, and begin dreading the next day. Becoming clear on where you want to go, what you want to accomplish, and whom you want to become and embed the image firmly in your mind before you go to sleep. Napoleon Hill called it “envisioning your Chief Aim.” Doing this before bed activates your creative subconscious mind while you sleep. I heard Napoleon Hill told himself before he went to sleep one night, “I need a title for my book,” and he woke up with the title “Think & Grow Rich.”

“Success comes from growing, not from achieving, acquiring, or advancing. If you commit to growing each day, you will soon start noticing positive results in your life. Every action you take towards growing will bring you closer to success; it doesn’t matter how small your action is or how slow you go as long as you keep going.” John Maxwell.

Just like you write a business blueprint or plan, complete one for your personal life. What do you want to accomplish? Our business is not our identity; all of us will come to a time when it’s time to leave the arena, and in the end, what do you want to have accomplished? How do you want to be remembered when it’s time to leave this earth? What regrets don’t you want to have? Jot these down in a journal where you can refer to them and celebrate each action you take that moves you one step closer to where you want to be and whom you want to become. At the end of the day, look back on what went well, and think about where you want to go, and whom you want to be. The journey seems long, but don’t become caught up in the results; enjoy the process, and the results will come. Cheers to your success!

Jenny Mason is a regional business development manager with Movement Mortgage. She is 100 percent a servant leader building relationships, encouraging people, igniting passions, and adding value for all. Jenny is passionate about encouraging, serving, and inspiring people to overcome their limiting beliefs, to reach for the sky, excel more, ascend higher, and live life more abundantly personally, professionally, mentally, physically, and spiritually!

Jenny is one of the many incredible Coaches at 20/20 VSC.

A Gratitude Mindset

Written by: Ruth Lee, CMB

In the 80s, my mother decided to open an accounting firm with her brother. It was Gonzalez & Varnado, CPAs. My father was so proud. My mom had been the type of partner any husband wants. She was warm, confident, and ambitious. She understood the value of hard work. She provided a firm launch for her family into middle-class comfort and security. I watched every move she made as she exposed me to the risks and rewards of entrepreneurship.

At twenty-six, I started a mortgage company in Austin, Texas. And it was hard. Even as the industry was ramping up to a serious boom, I had to learn the art of running a company and managing people, all the while being an active producer. I was so naïve. But every day, I learned more and more. I had this huge weight of responsibility I had forced upon myself, and I didn’t want to shirk the challenge. I felt like the only way to honor it was by becoming pretty grim and determined.

Today I see a lot of this happening. As I work with executives across the industry, the seriousness displayed is often misunderstood or misinterpreted, especially by younger executives, originators, and employees. It isn’t that there is a lack of care or compassion by executives, often, it is just hard to navigate being both a steely-eyed businessperson working to save a business during a downturn while also being optimistic and growth-oriented. How do you smile and inspire at a time when you are making grave decisions that permanently impact people’s lives?

As we go into the New Year, here are a few important resolutions I encourage all executives to embrace.

- Separate fact from fiction. Be open and honest. Now more than ever, it is important to communicate reality to your team. Let them know what your plans are and how they can contribute to the company’s success. What does success look like? Ensure everyone knows their role in the communal effort of ensuring your company’s profitability and longevity. Solicit their help and collaborate with each of them on how to build a more resilient organization.

- Invest in the obvious. From productivity to product diversification, now is the time for your team to bring their A-game. You need a winning team; not a mediocre one. Don’t shy away from being bold, and lean in. And as you lean in, recognize and reward those who are a part of the solution. Identify those who embrace a growth mindset, especially now, when it is hard. Isolate anyone looking to wallow in the “hard” rather than see and experience the challenge and opportunity. There is enough negativity from the outside looking to foster doubt without you having to fight it from within.

- Shift your focus from weaknesses to strengths. When you make cuts, you are forced to focus on areas of weakness, whether mental fortitude or technical expertise. Once this is accomplished, it is time to shift your thinking rather than concentrating on the next round. Put that mindset aside until it is needed again, and spend your energy focused on your assets and how to deploy them to your benefit.

The last important resolution is one I encourage you to perform every day. Practicing gratitude should not be reserved for Christmas or the New Year. Scientific data supports the benefits to practicing gratitude daily. People who practice gratitude and are aware of and reflect on what they are thankful for, experience positive emotions, sleep better, feel more alive, are more financially successful, and have stronger immune systems.

Practicing gratitude can be as simple as waking up every morning and taking thirty seconds to think about and express what you are grateful for in the mirror, the car, or a journal. To live with gratitude means you recognize that all your accomplishments, your abilities, your gifts, and even your challenges are blessings. And it is up to you to find joy in each of them. But it is not enough to find your joy; the next challenge is to express your gratitude to the people in your life.

Gratitude is a state of mind. It can be secular, where you practice an attitude of appreciation by actively thinking and thanking. It can be biblical: “Always be rejoicing. Give thanks for everything.” 1 Thessalonians 5:16, 18. Either way, being intentionally focused on your gratitude is a hedge against darkness and pessimism waiting to drag you and your success down.

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations, and overall business growth.

Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Servicing Transfer Best Practices. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory, and legislative changes.

Ms. Lee holds a B.A. in Economics from Mount Holyoke College. She resides in Lakewood, CO with her husband Mike, her black lab Ned and two cats, Jefferson and Adams. Winter months find her and Mike riding every peak they can find.

.

Written by: Megan Anderson

The theme of The Vision magazine this month is “Cheers to Your Success.” While the end of the year is a perfect time to reflect on the past and plan for the future, the current market has caused many of us a great deal of fear and worry.

Rates are almost 4% higher than they were a year ago, while the Fed’s hikes to the Fed Funds Rate and uncertain economic conditions have added to the volatility in the markets and mortgage rates. This has caused many would-be homebuyers to delay their purchase.

As a result, the Mortgage Bankers Association (MBA) expects total mortgage origination volume to decline to $2.05 trillion in 2023 from the $2.26 trillion anticipated in 2022. Purchase originations are forecast to decrease by 3% to $1.53 trillion next year, while refinance volume is expected to decline by 24% to $513 billion.

This could mean less money in our pockets and more challenging, more complex deals to come by. Many companies feel the slowdown, and we’re being bombarded with headlines and fears of pay cuts and layoffs.

But there is reason to say cheers to our success!

Later in this article, I will highlight MBS Highway’s market and inflation forecasts which will make you want to say cheers to the future. But for now, I want to remind you these cycles are a natural part of this business.

Success is a choice, and the strong will survive and thrive.

A Powerful Reminder

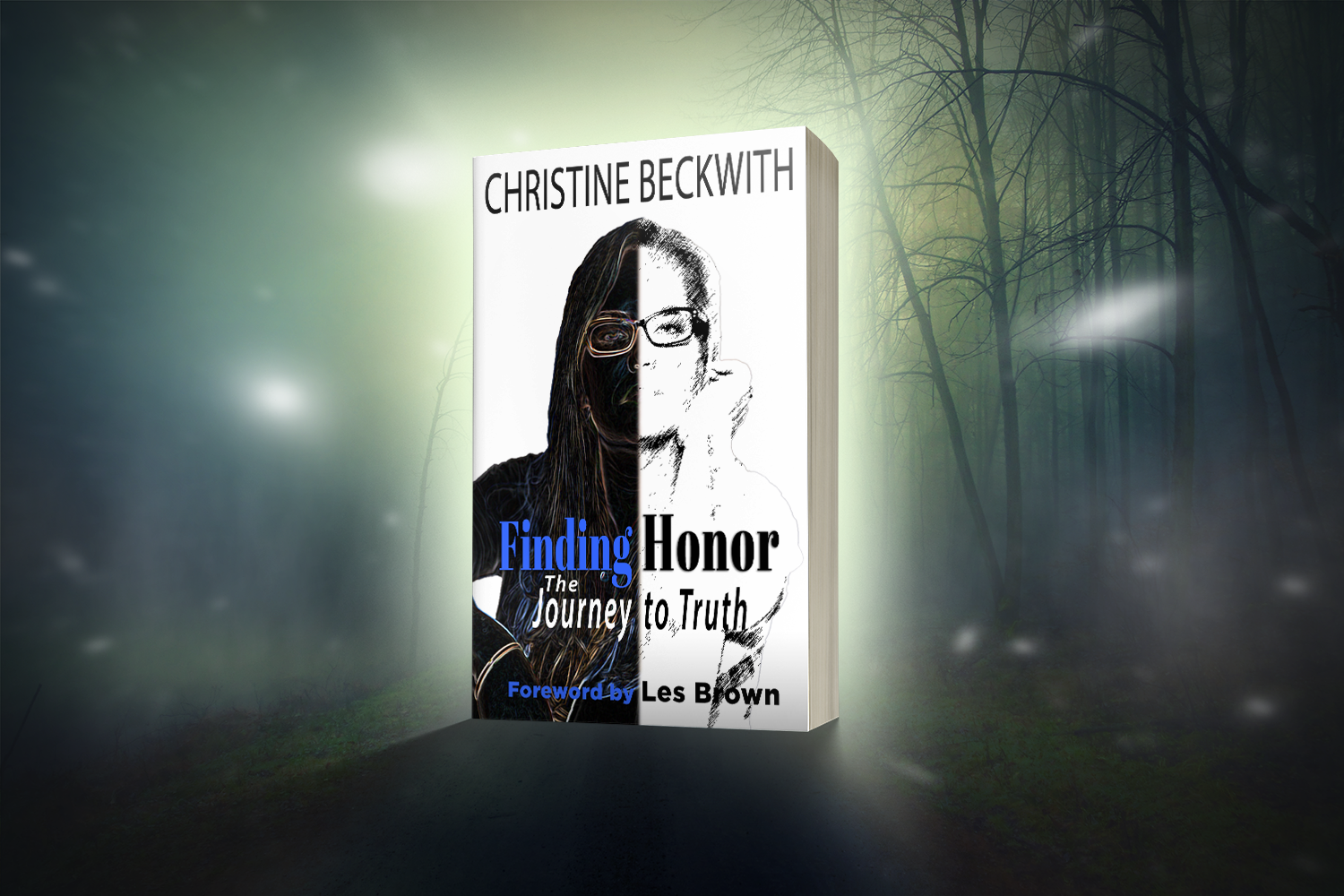

I recently finished reading Christine Beckwith’s new book, Finding Honor: The Journey to Truth, where she shares her story of going through one of these cycles during the housing crash of 2006 through 2008. She had just become the VP of Sales at H&R Block Mortgage.

For more than a decade, Christine had worked toward this opportunity, taking her team from last place to first place. Little did she know the mortgage industry was about to crash. After building her team, she now had to downsize and lay off the people she had spent years cultivating and believing in when no one else did.

Circumstances like this and like the current environment we’re in can make it challenging to see anything but pain. It can be easy to stay in the habit loop of poor me or it’s the Fed’s fault. But here’s the thing. Staying in this mindset isn’t going to lead you to success. It’s the fast track to a “slow death,” as Christine puts it.

It’s a victim mindset.

I want to highlight the outcome of Christine’s experience because it teaches us an important lesson: It’s up to us to choose happiness.

Christine said, “Years after this traumatic career intersection, I understood going through this tumultuous time was how I earned my true executive leadership wings. Until you lead in down-turned markets, you have not yet experienced leadership. Until you have had to give hope during hard times, give continued strength during bad markets, keep folks focused, and at work with a winning mindset despite taking losses, you don’t know the depth of leadership.”

I’m in a unique position where I hear the stories and challenges many of you are currently facing, and Christine’s insights are so valuable for leaders today, from branch managers to C-level executives.

Plus, there are reasons to say cheers to your success and to the future. First, I’ve seen a lot of people give up and leave the business. It would be best to cheer on the fact that you’re staying strong while learning to navigate this market. Markets like the one we’re in today shed dead weight while committed people hang in there. They see the bright side to come and capitalize on the business of those originators who left.

Where Are the Markets Headed?

Speaking of the bright side to come, a significant reason mortgage rates have moved higher this past year is due to inflation. In order to understand the future of the market, we must understand inflation.

Inflation is the arch-enemy of fixed investments like Mortgage Bonds because it erodes the buying power of a Bond’s fixed rate of return. If inflation is rising, investors demand a rate of return to combat the faster pace of erosion due to inflation, causing interest rates to rise, as we’ve seen this year. In other words, inflation is going to drive mortgage rates.

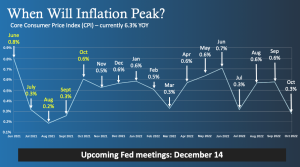

One report we look at to measure inflation is the Consumer Price Index (CPI). CPI has two main components: Headline Inflation (overall inflation) and Core Inflation, which strips out volatile food and energy prices. In addition, inflation is calculated on a rolling 12-month basis, which means that the total of the past 12 monthly inflation readings will give us the year-over-year rate of inflation.

The MBS Highway team had circled November 10 as a crucial date for some time, as this marked the release of October’s CPI data. For months, we explained that we felt this report would mark the start of a deceleration in inflation, which would, in turn, bring a moderation in mortgage rates.

Looking at the graph below for Core CPI, you’ll notice we were correct in our thinking. Core CPI for October 2021 was elevated at 0.6%, and it was replaced with a much lower reading of 0.3% for October 2022, causing year-over-year Core CPI to move lower from 6.6% to 6.3%. This decline should continue as we replace the readings for November, December, January, and February, all of which are elevated.

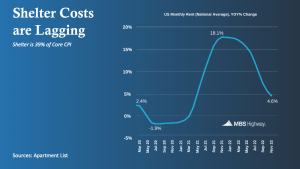

In addition, the Fed’s hikes to its benchmark Fed Funds Rate are finally starting to slow down the economy, helping to curb inflation and moderate mortgage rates. Plus, shelter costs make up 39% of Core CPI, and they saw their largest monthly increase in the index’s history in October, meaning they played a substantial role in the monthly gain. However, they have been lagging in the CPI report.

In more real-time data, we are seeing a moderation in rental prices. Below you’ll see a graph from Apartment List, showing that year-over-year rental prices peaked last fall at 18.1% and have since moderated to being up 4.6% year over year. These moderating shelter costs should be reflected in the CPI data hopefully by January, which should add additional downside pressure to inflation.

It is not out of the question to see rates in that 5% arena in the first part of next year, maybe a little bit above, or a little bit below. But better times are ahead. I want you to stay optimistic.

MBS Highway’s modeling is working, and you can stay up to date by watching our daily morning update video, where we break down all the housing and economic news. Take a free 14-day trial of MBS Highway and learn more about how our daily coaching videos, lock alerts, financial calculators, loan comparisons, and more can help you better serve your clients and grow your business now and for years to come.

Our modeling shows the housing market has a tight inventory, and household formations have slowed because people are hibernating in this 7% rate environment. But because of this inflation picture which drives mortgage rates, we should see rates decline into the 5% area as inflation continues to decline. When this happens, we will see a slew of buyers unleashed into a tight inventory environment.

But that doesn’t mean your clients need to wait for rates to come down to purchase a home, especially since they may have to deal with stiff competition. Now might be the opportunity you’ve both been waiting for.

The Opportunity You’ve Been Waiting For

Not too long ago, the housing market was on fire. Buyers often had to bid above the asking price among multiple offers, and many even waived inspections and bought a home sight unseen. Now buyers have more negotiating power, and instead of just getting a price reduction, they can ask the seller to contribute towards a 2/1 buydown or a permanent buydown. You can use MBS Highway’s 2/1 buydown and Seller Contribution tools to help illustrate the best option for your clients. Watch this video to learn more.

Lastly, I want you to take a moment to be proud of your success. Even if your volume isn’t where it was last year, say cheers to the simple truth that you are a fighter; you are keeping a positive mindset and riding out the storm. And when we get to the first quarter and especially the second quarter of next year, we can say cheers to lower rates and an influx of potential buyers.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

Finding Honor: The Journey to Truth

Written by Peter Wietmarschen

This month I have the special privilege of reviewing Christine’s new book, Finding Honor: The Journey to Truth. Finding Honor is Christine’s story about finding herself and learning to honor herself in all areas of her life. After all, no matter what we say, if we cannot honor ourselves, we cannot honor those whom we work with and those we serve. These relationships are only strengthened when we can internally honor who we are, where we’ve come from, and what we plan for our future.

At its heart, Finding Honor is Beckwith’s memoir but spread throughout is her personal advice to the reader about how to find our own honor. She approaches these nuggets of advice from a place of understanding, if not a bit on the nose, to make sure her advice is heard even by those who may not truly believe they are living a less-than-honorable life.

“I am an excellent storyteller.” – Christine Beckwith. It’s true, Christine can tell a story like no other, and she does just this in Finding Honor. Throughout Finding Honor, Christine shares personal anecdotes across her life. From early memories of her youth to her personal struggles with addiction, from lighthearted antics with her friend to the eventual eroision of that very same friendship, from her personal relationships to how she has helped others avoid a messy business downfall due to their own relationships, and so much more.

The theme throughout Finding Honor is Christine’s continued ability to bring herself back to a place of honor, no matter how far she may have strayed. As a reader, you can see Christine lives by a moral code she sticks to because of her innate sense of right and wrong. In a sense, these chapters are her own unique way of imparting wisdom to the reader and sharing her moral code with those who are looking for guideposts on their own journey to discover their truth.

And still, sometimes, these stories are not so much Christine finding her path to honor but creating her own honor where others may not see the same opportunity. No friendship is perfect, no two people go years without conflict with each other. Without giving away the ending of one of her stories here, Christine shares the story of a dear friend who, for various reasons, stopped communicating with Christine, and they grew apart. This is not something unusual; this is something which happens every day between friends. When a friendship ends with accusations or false beliefs, it takes a toll and leaves emotional scars. Honor is rarely found in times like this, yet Christine tells the story of finding honor within herself and living the truth of her life, even as she had to mourn the passing of her once dear friend from afar.

On a personal note, here, I find it somewhat difficult to sit down and read a person’s book who signs your check. It is not that I find Christine’s book to be too personal; in fact, I found a few of her stories could be a bit more personal. But the difficulty I find is how to approach this book with an open mind and objectivity. I would hate to sound overly praiseworthy of a book just because I could potentially gain favor with Christine. On the other hand, I would hate to be too critical of a book just for the appearance of being impartial, like the youth baseball coaches who are harder on their own children.

This dilemma is the perfect example of what Christine is talking about when she says we need to find honor and live in truth. I know I must be true to myself and give a complete review, including all of the good and all of the bad. And I know that Christine, living in a place of honor and truth, a resilient soul, and someone living in a place of truth, will be able to understand any criticisms I might have.

That being said, as good of a storyteller as Christine is, there were a number of times when I just wanted more. In fact, I think this stems from the times in Finding Honor, when you just can’t put the book down. I truly can feel Christine’s emotions throughout the book. Maybe this is just me being greedy.

I feel like I am right there beside her during some of the darkest days I can imagine in her story. I know the quality of storytelling Christine can give, and I want that throughout. After reading this book, you will find the same connection to Christine. It does not matter if you are someone who is secure in their internal moral code or if you are looking for guidance in your life; this is a great read for you. I would suggest everyone who is in any type of leadership role read Finding Honor: The Journey to Truth.

My rating is 4.25 stars.

Peter is a proud, lifelong resident of Cincinnati, Ohio. A graduate of Morehead State University with a Bachelor of Arts in Music in Saxophone, Peter is a music lover at heart. In his daily work, Peter has turned his creative mind towards writing and works as a publishing consultant for authors. Peter enjoys working with local marching bands as an instructor.

Peter is a proud, lifelong resident of Cincinnati, Ohio. A graduate of Morehead State University with a Bachelor of Arts in Music in Saxophone, Peter is a music lover at heart. In his daily work, Peter has turned his creative mind towards writing and works as a publishing consultant for authors. Peter enjoys working with local marching bands as an instructor.

Peter joined the magazine team at 20/20 Vision For Success in June 2020 and has been working behind the scenes on several projects such as the Women With Vision Awards and the Vision Summit. Besides the magazine, Peter also writes for other clients and advises writers on their book projects.

Outside of work, Peter is an avid soccer fan who supports FC Cincinnati. He is a member and former board member of The Pride: FC Cincinnati Supporters Group. Besides FC Cincinnati, Peter watches the US Men’s and Women’s National teams.

BEST SELLER BOOK LAUNCHED!

BEST SELLER BOOK LAUNCHED!

On October 11, Finding Honor: The Journey to Truth, Christine Beckwith’s powerful new book, rose quickly through the Amazon New Release and Best Seller ranks to land at the top of the heap! If you missed the launch, please do yourself a favor and grab a copy today. Critics are hailing it as her best book yet.

And be sure to catch these other great reads from Christine Beckwith. Feel free to go grab them now on Amazon!

Breaking the Cycle is filled with engaging stories wrapped around a theme of power words and is an invaluable treasure trove of practical, hands-on advice. Jam-packed with easy-to-implement suggestions, you’ll read sage advice from two women whose diverse career paths literally write the book on how to create your version of success!

In Wise Eyes: See Your Way to Success, Beckwith tells her life story in a style that is real and raw, but brutally honest. Wise Eyes is a handbook for professionals wanting to walk a direct path to incredible success.

And in her most recent book, Win or Learn: The Naked Truth, Beckwith joins more than a dozen other C-Suite professional women from across the mortgage, real estate, and finance industry for frank discussions about what it takes to succeed as a woman in the top eschelon of business in today’s world.

Are you a reader who likes to share the wealth and benefit received from consuming a great book? Just as we welcome Peter Weitmarschen and Leora Ruzin to these pages as book reviewers, we would be delighted to welcome you as well. We consider all submissions. Reach out to us at magazine@visionyoursuccess.net and let’s talk books. –Editor

Beckwith Unplugged and Uncensored

Season 3, Episode 25: Influence Is Not Something You TRY To Have

Don’t try to influence people, just do it.

If you are unsure how to do it, listen to this episode and then give me a call and let’s unpack whatever it is we need to unpack so you understand that you are able and good enough to exude all the influence you want as long as your promise to do one thing…

Tell the truth.

My door is always open for you.

ABOUT THE SERIES

Beckwith Unplugged and Uncensored is video podcast designed for Christine Beckwith, a long-time business executive turned executive coach in the banking, mortgage, and real estate industry. In this totally transparent and sometimes raw monologue, Beckwith tells it like it is…publicly. Emotion is the driving force behind all human intellect, accomplishment, and success. If you cannot feel where you are going, you cannot SEE it either. As the visionary behind 20 / 20 Vision for Success, Christine brings her personal and professional philosophy to the mic. Listen in because these are lessons you will want to learn here instead of anywhere else.

Subscribe today!

Self discovery is now part of the buying process. Pre-framing can help you control that.

Learn how Vonk Digital can help you leverage the New Way to build your brand, authority, and credibility with our website platform and tools. Visit us at www.vonkdigital.com

Read this vlog episode, if you prefer, on the Vonk Digital blog!

Vonk Digital, an industry leader in website and marketing tools for mortgage originators across America, is a proud sponsor and hosting partner of The Vision Magazine.