MERCURY RISING: NEXA’S MIKE KORTAS and MAT GRELLA, The Disruptors!

In the broker solar system and banking world, NEXA is Mercury. NEXA’s co-founders, like Mercury, are complex and unique, tenacious and strong.

I

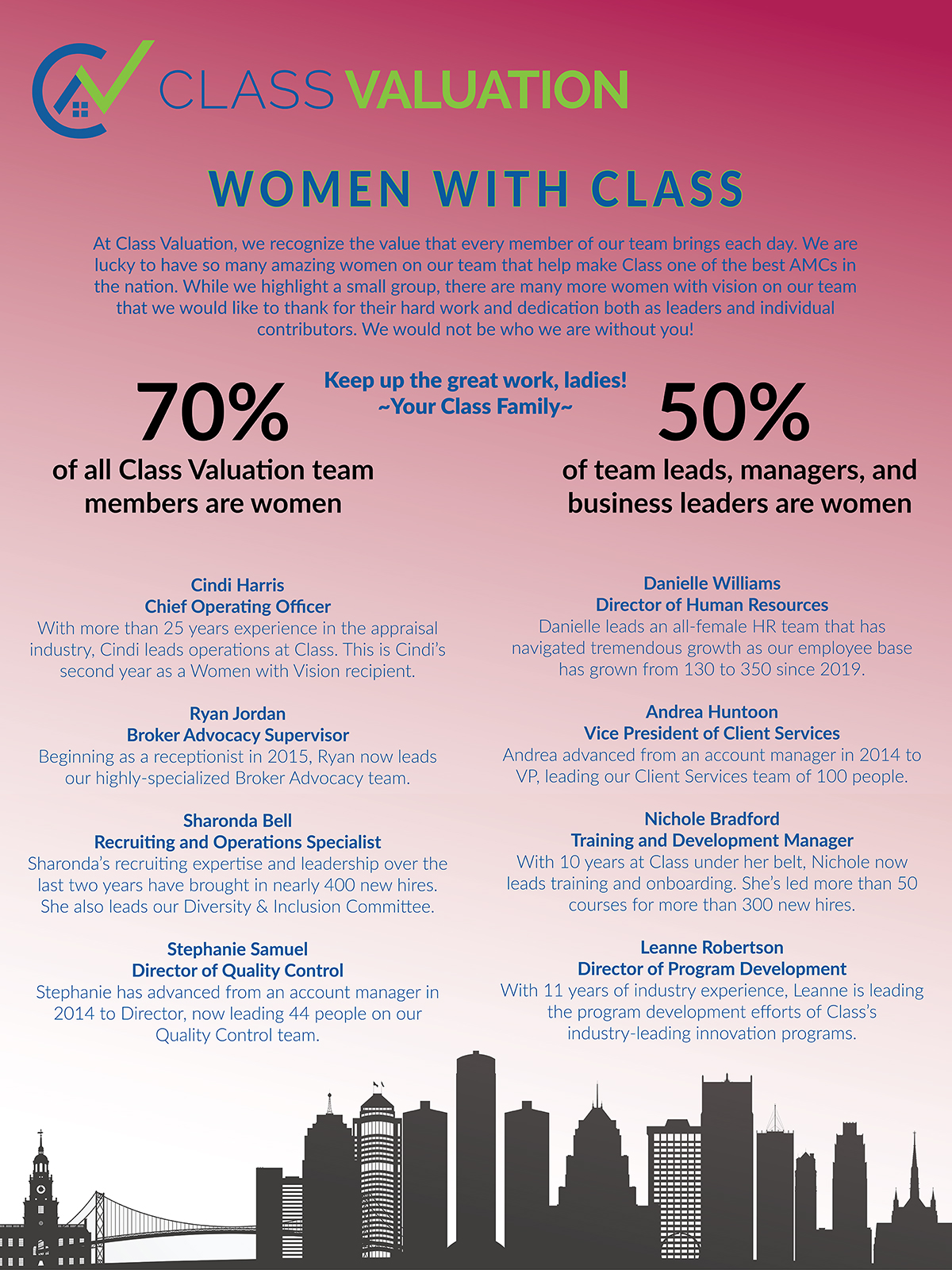

n this edition of The Vision we are clearly not sitting back on our laurels following a successful summit and entering into the heart of summer. We’re proud to be bringing our readers outstanding knowledge pieces from MBS highway and our own Coaches ConnXion. Thoughtful and interesting articles from Ruth Lee in Diary of a Leader and Laila Khan in Celebrating leaders. And of course the plethora of original writing from our regulars as well as a new feature sponsored by Class Valuation celebrating often unheralded yet deserving women in the industry.We hope you find each of the features and stories presented here worthy of reading and sharing.

As always, a big Thank You goes out to all who have subscribed to both magazines. I hope you enjoy today’s issue and will share www.TheVisionMag.com in social media. Reach out and congratulate your peers whose bylines and profiles appear in these pages. Tag us in your posts #thevisionmag and #2020visionforsuccesscoaching. We love the feedback!

magazine@visionyoursuccess.net

I am proud of this edition of The Vision Magazine and to be featuring the incredible and dynamic duo of Mike Kortas and Mat Grella, CEO and President of NEXA, the largest brokerage in America. Their story is an incredible coming together of two great minds. We hope you enjoy reading it and are inspired when you read their words.

As summer draws on, I see the industry picking up speed with conventions and travel occurring again. We are poised to be on the road again ourselves and will present at many of these great conventions. We are excited to have an incredible reach now in the industry and to have all cylinders firing in many directions. This summer we will visit the heartland of Texas for Summer Camp with the one and only Christopher Griffith, CEO of Vetted VA, to support the veterans and this great leader’s vision. This fall you will find us at the AnnieMac Annual Summit in Philadelphia, the NEXA fest in Arizona, and the mPower event with Marcia Davies in San Diego followed by the MBA conference in the same location and then our very own winter retreat in the Midwest in early November.

Please continue to share our editorial with your networks; we know our media will grow most through word of mouth so please grab the link here www.thevisionmag.com and share this month’s edition or drop a comment or a screen shot of your favorite article. The greatest compliment you can pay us is the sharing of your story, so we thank you in advance.

info@visionyoursuccess.net

WRITE FOR US

Yes, we do accept submissions. If you are a writer interested in being featured in a national publication, we will be happy to consider your ideas and your article submissions. We are also interested in recurring columns centered around our featured topics. The place to start is by clicking the button and inquiring.

MERCURY RISING: MIKE KORTAS AND MAT GRELLA

Written by: Christine Beckwith

Metaphorically, Mercury Rising (not the film) refers to the orbit of Mercury, the mythical ruler of all the planets, as it wanders swiftly across the heavens. A person or entity under the influence of Mercury rising is thought to have an ever-changing and searching mind. It implies one who is forever evolving. NEXA is a company undergoing constant evolution and incredibly rapid growth.

Mercury is a singularly disruptive, tricky character, in both mythical and astrological interpretation, considered infinitely clever and full of wiles. Every time we pick up a pen, state our case, or travel hither or thither, we are considered to be in the grips of Mercury. An interesting fact about Mercury is it shapeshifts to the planets it meets. Mercury is a ruler, exalted and synonymous with strength. As the biggest broker in the United States, NEXA can favorably be compared to Mercury in numerous ways.

Mercury’s placement in the solar system puts it in perspective to the sun in such a way to be most visible from the greatest distance. It remains allusive to its peers; much like NEXA.

Mercury is often prominent in the charts of speakers, writers, musicians, provocateurs, salespeople, negotiators, tradespeople, astrologers, therapists, and travelers. Additional themes that playout under the aegis of Mercury, and are found in the NEXA leadership, include:

- A natural place of play or discovery

- Our powerful place of persuasiveness

- Our connection to curiosity

- A place of changeability

- An area of cunning, transactions, trade, and negotiations

- Skills of the hands, travel, and journeys.

In the broker solar system and banking world, NEXA is Mercury. NEXA’s co-founders, like Mercury, are complex and unique, tenacious and strong.

In the Beginning

Several years ago, I had the pleasure of sitting on a panel in Atlantic City, NJ, discussing the topic of recruiting with CEO Mike Kortas of NEXA and several other strong, dynamic industry growth leaders. I had spent my prior dozen years helping grow and scale a national lender. Mike Kortas represented the fastest-growing brokerage in the country. Everyone in the audience wanted the absolute best advice from us as leaders and I especially enjoyed watching Mike share his wisdom with a palatable audience. We spoke briefly afterward, and I remember liking Mike and thinking he was a brilliant man.

The next time I saw Mike Kortas, and NEXA President and Co-Founder Mat Grella, it was as I was racing onto a stage at the Bellagio to speak alongside Mike once again. This time I was the moderator interviewing panelists on the topic of growth and success. Mike was again an elite panelist representing his incredible growing firm. Later again, I saw them in Irvine, CA for yet another conference. This time I purposely sought them out to talk about their firm and coaching. My firm was aligned with the broker community and Mike had previously expressed a desire to learn more about how we could structure a partnership, placing NEXA (already the biggest in the business) as also the best. In Mike’s lexicon, best meant having all incoming loan originators (LO) enroll in an expansive curriculum and coaching process leading faster to production. He envisioned turning out professionals who are more experienced, educated, and well-rounded experts representing the NEXA brand. The rest they say is history.

In the past year, NEXA has taken leaps in direction to secure a stronger recruiting value proposition with the grit and stickiness to keep their new, and many times green, employees in their seats and productive. This initiative has breathed new life into their company and it promises a stronger foundation of greater producers. As time has passed, they have culled their herd to ensure the richness of their firm and the body of the professional employees grows expeditiously every single day. Mike Kortas and Mat Grella, founders of NEXA, are here to stay, grow, strengthen, and continue to tell their beautiful entrepreneurial story.

It is my opinion and observation this firm is underestimated in what it will become in the years ahead. I think they are perfectly positioned to take their competitors by surprise. Having had admittedly loose vetting practices in the past, they have sharpened their pencils and are no longer operating without consultation. They are operating from a solid plan with already proven results.

The partnership is fruitful on both sides. We have many dynamic consulting relationships, with NEXA currently our largest firm. Consulting with NEXA has blown a great wind into the sails of our growth at 20/20 Vision for Success Coaching. NEXA came on at a perfect time in our trajectory and we have embraced the challenge of training their incoming rapid-fire hiring, complete with adding six additional staff members who are dedicated to this enormous account as well as a couple more dozen affiliate coaches and student ambassadors supporting the many hours of monthly, LIVE and virtual curriculum, accountability activity, and volume forecasting that goes into helping create hundreds of unique entrepreneurs.

I have come to love and admire the diversity of this dynamic duo. Mat is the empath, clearly with the prowess of a natural-born leader but with careful consideration of people’s purpose and feelings. Mike is a tenacious no-nonsense leader, also caring and loyal, charming and conflicted, which are the elements of an incredible results-driven leader. As their executive coach, I am impressed with their ability to drive an enormous bus and do so with true simplicity and grace. The model just works; whether it is disliked by their competitors or even denounced for being unlike the norm, it is working, and they are beating the odds.

Their statistics are constantly evolving and their funded units per LO is on rapid growth as their coaching and mentoring model has evolved in the past year. The ebb and flow of their everyday business plan leaves them in complete control of this massive entity and in a calculated way, more so than they are given industry credit for.

Meet Mat Grella, President of NEXA

Christine: When did you start in the mortgage industry?

Mat: “I started in the mortgage industry in January 2016. My first job was with Security National Mortgage Company and Mike Kortas was my branch manager. I was brand new to mortgages, but I had many years of prior experience in sales and leadership. I wanted a career where I felt challenged and more importantly, I wanted to feel rewarded for the grind.

I began as a loan officer at SNMC and in a short time had established myself as a top producer. After six months at SNMC Mike approached me with an opportunity to help establish a branch at Equity Prime Mortgage. I quickly jumped at the chance and continued my success with EPM. Over the next 12 months, I became more fluent with writing loans and studying guidelines, so I used my skills to help other loan officers develop theirs.

After doing much research on the broker model and the numerous advantages being a broker could provide my clients, I decided being a broker was the next step for me. I parted ways with Equity Prime Mortgage and met back up with Mike and we started NEXA Mortgage, LLC where I have been since. That was in October 2017.”

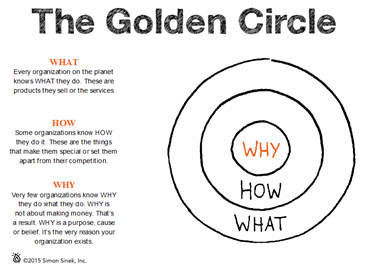

Christine: What is your WHY?

Mat: “My WHY is made up of many things. First, my children and my family. I know that sounds cliche but in the simplest form that is it. I love my children and I work hard every day for them so I can give them something they can be proud of and more importantly, something they can pass on.

Second, all the naysayers. Tell me no and watch me go. I am persistent and at times stubborn. What really fuels my fire is telling me I can’t do something. I get a lot of pleasure proving people wrong and proving to myself I can do it. I love to be challenged and every day it seems to be something new driving me. When we first had this vision of NEXA, everyone, from other brokers, lenders, account executives, and everyone I told, they would all say with a smirk, ’yeah, well, good luck with that, brokers are not meant to be big.’ Challenge accepted. Those words were all it took.”

Christine: What is your Vision?

Mat: “My vision for NEXA in the next five to ten years is to be the largest independent mortgage company in the U.S. We are already the largest mortgage broker, so it is only natural we continue to push. Some people may take that as a shot, but it is just our goal. We take nothing away from the accomplishments of others or their goals. We just know what we want and what we are willing to do to get there. We have the drive, and we never cheat the grind. There is no room for complacency.

I am proud of the culture we have been able to create at NEXA. Mike and I have always been a matter of fact, tell it like it is, do not sugar coat it, take the punches and dig down in the trenches guys. There is nothing special about us; we are blue-collar and make sure we do what we say and say what we do. We’ve been able to create this by being readily available to all our people. How many companies are there where you can schedule a sit-down with your President and CEO daily?

I am most proud of our diversity as a company. It is something we truly embrace, and we work hard to make sure everyone at NEXA has a voice and we listen to those voices. We have always said we do not direct the company, our LOs do. We meet weekly with them and invite them to bring their concerns to the table. If something needs to be fixed, we fix it fast.

We are not perfect, we have our flaws and kinks we still need to work out, but you will never find two people more willing to take on the challenge. As far as diversity goes, we place a premium on it. We make sure our CORE Value of Treat Others as You Want to be Treated is always at the forefront of our daily interactions. We love to learn from others and embrace the differences everyone contributes to the collective good of the group.

We have the most amazing people here at NEXA and it is only fair to all of NEXA Nation for us to do our job to be an ambassador to one another.”

Christine: What are your hobbies when you are not working?

Mat: “I love watching my kids play sports and be part of whatever they are doing. I love spending as much time with my family as possible. I am a big sports fan and a native New Yorker so anytime the Giants, Mets, or Islanders are in town I am there. I also grew up a huge Michigan fan so for the past three years I have tried to go to the BIG HOUSE for the homecoming game.”

Mat’s Favorite Quote:

“The difference between a successful person and others is not a lack of strength, not a lack of knowledge, but rather a lack of will.” Vince Lombardi

Meet Mike Kortas, CEO NEXA

Christine: Tell me about your background, Mike?

Mike: “I have been in this business since 1998. Starting out primarily as a sub-prime loan officer I had some hard times and decisions to make after the financial crisis. I rebuilt my business and focused on sustainable growth models within the mortgage industry.”

Christine: What is your WHY?

Mike: “My WHY is a little different than what many people would think. I really strive to be the Greatest of All Time (GOAT) because others have told me I cannot, or others have said I could not; from grade school educators, Mr. Alton and Ms. Slusser, who both said people like me are hobos, to the family who thought I should have been adopted out or aborted from the get-go. Drama has always been a part of my life even as a child and it is through personal growth I prove them wrong and provide a stable environment to grow my legacy. I was homeless on my 18th birthday and had been in and out of juvenile detention centers before then. The road did not start on a smooth surface, but it is my job to make sure it is better for generations of family to come. My WHY started out to prove everyone wrong, to tell them they were wrong, and I have done it with a chip on my shoulder no doubt.”

“I have a new WHY though, and it is the legacy I leave. It is not about my three wonderful children, and they know that. I am not doing this to give them the greatest life they ever had or to provide them with things I could only envy of others as a child. They may tell their friends I was not there for them much because I worked so hard, and that is okay with me. My WHY is for the grandchildren I have never met. My WHY is for the great-grandchildren I never will meet. I do this so I can change forever the outcome of my family’s precious legacy. I do what I do so generations to follow will talk about me with inspiration even though they never actually had the opportunity to meet me. It is my children’s responsibility to carry on my legacy for their grandchildren and generations after them. It is about the legacy.”

Christine: Tell me about NEXA and its history?

Mike: “NEXA will always be the best company for self-producing loan officers to work. Right now it is, in five years it will be, and in ten years it will be. We will constantly strive to innovate and make sure nobody offers their LOs more than we do or can. We do not know what NEXA will look like in one year, let alone five years, but I can guarantee you it will not look like it does today. It will be better, and it will change constantly to make it better.

For NEXA, I was the proudest when we earned a bootstrap award; an award not just within the industry but the entire world. In the first half of 2020, NEXA was recognized as the fastest-growing financial company in the world without institutional investors. We did it with good ole fashion blue-collar grinding.”

Christine: What are you most proud of?

Mike: “Personally, I am most proud I didn’t own anything except a backpack with a few articles of clothing on my 18th birthday, and today I can enjoy almost anything I want. Nobody can tell me how to do things and I created this on my own. It’s amazing as I’ve come full circle I don’t really care for many things. I enjoy the simple word SUCCESS, likely because I stick the middle finger up to all of those who told me I could not in the past. (I’m a little childish that way, but it’s what happens when someone has a chip on their shoulder.)”

Christine: What are your hobbies?

Mike: “My hobby is business. I love doing what I do more than anything. I dabble in other hobbies but always turn them into businesses anyway. The number one thing I enjoy doing outside of business is watching my youngest son dominate and grow in athletics and business to obtain his goals. He has a motivation at 15 that inspires me, and I just must tell the world to look out. If you think I did great things, this kid is going to blow the doors off with the opportunities I have been able to start him out with. “

Mike’s Favorite Quote:

Eric Thomas is known as ET the Hip Hop Preacher. He is a motivational speaker, minister, and author. This is a paraphrase from one of his books that resonates strongly with Mike, “You may come from money, you may have an education, your daddy may own a business… but you will NEVER outwork me.”

In ending this wonderful sharing of another incredible success story, I want to explicitly state my inclusion in the broker movement has forever changed me and my organization. As with anything, I have become aware of the personalities and nuances of their minds and hearts and as such I stand with them in their quest for growth and excellence. I am honored to be on Mike and Mat’s journey and their trust in us has become a big part of our firm’s journey as well. As such, we are two companies with an incredibly great trajectory and have added to the success of each respectively by combining our missions.

Christine “Buffy” Beckwith is an award-winning executive sales leader who has spent the past 30 years in the mortgage finance industry. Her life and career are filled with a progression of success stories reaching all the way back to her childhood.

Christine “Buffy” Beckwith is an award-winning executive sales leader who has spent the past 30 years in the mortgage finance industry. Her life and career are filled with a progression of success stories reaching all the way back to her childhood.

Be sure to subscribe to both magazines: The Vision and Women With Vision Magazine. Subscription is FREE and the only way to be sure you won’t miss a single issue of either magazine!

KIM KRICK: Survive and Thrive with a Bit of Sass Mixed in!

Written by: CaZ (Candy Zulkosky)

It is always interesting to learn how a person who is super successful in their work came to the profession. In the mortgage world, backgrounds are wildly varied and often have no relationship to the financial world. Let’s face it, no one wakes up on their fifth birthday and says, I’m going to be a loan originator when I grow up!

Thirty (or so) years ago, Kim Krick walked away from her training and a career as a phlebotomist to help out her husband in his mortgage business, and a new, totally unexpected career was spawned. Kim moved into wholesale mortgage work from an executive suite in 1986. Florida was her territory then, and to a large degree, it still is. She has risen to now be the producing manager of the whole Southeast Region for Freedom Mortgage. As First VP and SE Regional Manager, Kim shares wholeheartedly that her passion is helping her account executives reach their growth and goals!

“In business, I consider success to be truly making our brokers look good in the eyes of their realtors and borrowers. If we get any credit for growing their business, it gives me great pride. I would say my greatest success lies in being married for 33 years and being a mom.”

This philosophy and work ethic holds firm for Kim in all she does as a leader. She excels as one who leads by example and leading by making others better. Her ‘secret sauce’ is finding the strengths of team members then giving each person the chance to do what they are best at while getting out of their way. “I like to listen to my team and talk less. I handle issues with a sense of urgency when a loan goes sideways. I like to think my leadership style makes people feel like they can be themselves and have fun doing what they do every day.”

As a woman leader coming up through the ranks in the mortgage field, Kim feels she’s always been able to bring a different perspective to the table. There were times she had to work harder than her male counterparts to achieve her goals, but in today’s world, the unique strengths of each leader are being counted, regardless of gender.

For Kim, the best part about her career is the impact her efforts and the team’s efforts have on homeownership. Her favorite task is working with great people to make things happen, saying, “I still get a thrill when we take a first-time home buyer and put them into a home.”

Kim has a strong vision for the future of wholesale and believes technology is going to play a big role in how fast deals can be underwritten and closed. “Margins are tight in wholesale. The more efficient we can be with technology, the better we can compete. Freedom has changed from a regional platform to a national platform, and it’s made us more efficient. More wholesalers are going that way because the cost is so tight.

We enjoy having the Value Verify with Class Valuation for our appraisals as speed does play a big role in our future. My vision is to grow wholesale, to be the lender of choice for our brokers, both in wholesale correspondent and broker. We are working towards a goal to close all purchase loans within 15 to 20 days. I want to be the broker advocate for wholesale in our industry and help them grow their shops and businesses.”

Kim, a native Floridian, still lives in Florida with her husband of 33 years. Her one child, a daughter, is busy planning a November wedding. Kim beams when she speaks of her family, and especially her daughter, who is a writer working for Advent Health. When asked what one message she would want to share with her daughter about finding success in life, Kim responded, “To love what you do! The money will come but first, you have to really love what you do every day. And it’s important to not stress about the small things. Everything will work out how it’s supposed to be. And this is important for all of us. Worry less. Don’t sweat the small stuff.”

Kim’s favorite hobby is cooking great food. A few years ago, Kim made a lifestyle choice and is a follower of Dr. Mark Hyman known for the Pagan diet, a combination of Vegan and Paleo principles that advocates eating to prevent and beat disease. On this subject Kim shares, “I am a little bit of a health nut right now. I would say I put my health first but for a lot of years in my 30s and 40s I would put work first which was not good. Dr. Mark Hyman has helped me learn food is medicine, and to understand the link between diet and our brain health is profound.”

When Kim’s coworkers were asked about her leadership, Senior Vice President of Freedom Mortgage Corporation Wholesale Lending Division, Keith G. Bilodeau, shared his insight,

“Kim Krick is a leader her employees never want to disappoint, a characteristic that is attained by earning the employees respect, which is something sadly missing in today’s society. Kim leads her sales team by example and is outstanding at walking the talk, and showing what it takes to be successful in this highly competitive industry. Kim has never met a challenge she wasn’t ready and able to conquer. Customer service is more than a catchphrase for Kim, it’s truly something infectious within Kim’s DNA. She makes all of us here in the sales management team proud every day.”

Tips for Success

As is often true with strong leaders, Kim is generous about sharing her knowledge and experience. These tips are a few of the success habits she follows and encourages in others.

- Be committed. Through commitment, you can gain motivation and pursue success.

- Change your perspective. Positivity always puts a different perspective on things.

- Set powerful over-the-top goals. Freedom’s President (Stan Middleman) talks about goal setting as being a huge factor in success.

- Focus on a positive attitude. Always expect the best possible outcome for what you do.

- Personally, get more rest. Go to bed early, get up early. 😉

- Shop locally and eat fresh. Check out local harvest for your nearest farmer’s market.

- Fast track your exercise routine with interval training.

- Make the journey fun! The minute you make it serious, there’s a big chance it will start carrying a heavy weight.

Our closing thoughts center around Kim’s goals for life, career, and home. “It’s important that we do not accept no for an answer and that we are positive and help people do better both personally and professionally. And most of all, that we wake up healthy and make the most of the present.”

Her favorite quote from Maya Angelou caps it nicely,

“My mission in life is not merely to survive, but to thrive, and to do so with some passion, some compassion, some humor, and some style.” Kim adds this, “I like to say some sass, too, but style is fine.”

Great advice for anyone, I’d say.

CaZ, the Writer Success Coach, wears many professional hats all earned through experience as a professional writer, editor, coach, marketer, educator, and entrepreneur. Aside from her nom de plume when writing, she’s known as Candy Zulkosky and is the editor in chief of this publication.

As the Writer Success Coach, CaZ specializes in supporting writers. She finds joy in helping others to write and experience the joys of being published. CaZ coaches writers whose skills and experience range from the novice to the multi-published author. She tailors the coaching experience to best fit the needs of each writer and business professional she works with.

On the publishing side, CaZ is a multi-book published author and has edited or assisted in bringing dozens of authors to both print and to the best seller lists!

CaZ is pronounced KayZee in case you were wondering.

Written by: Fouad (Fobby) Naghmi, EVP

When I think of June 2020, I’m overcome by various feelings created by the memories I have of that month. The country was in the midst of a pandemic and many of us had no idea how long it would last. At the same time, the television news was replaying the brutal killing of George Floyd by a police officer in Minneapolis, and the streets of my hometown, Washington, DC, had become the flashpoint of all protests.

In the midst of all this, Tony Thompson, the founder of NAMMBA (National Association of Minority Mortgage Bankers Association) joined me on an interview for episode number 13 of Laugh, Lend & Eat. The interview had been scheduled weeks prior, and I could not have asked for a better guest to speak with at this moment in time.

For some added clarity, I think it’s important to understand before NAMMBA, I never felt like I belonged whenever I walked into an industry event. I mean, don’t get me wrong, I did what I had to so I could network with everyone. I always spoke with whoever I wanted to, but whether real or imagined, I felt I was missing out on some industry secret.

I can still recall the first time I walked into a NAMMBA event in Orlando, FL in the fall of 2018. I was instantly hit with this high energy; I could feel the openness of everyone, and the inclusivity drew me in as I had never been drawn in before. I looked around the event and saw a diverse group of industry professionals, all wanting to grow in their chosen field. It’s easy to understand why I hold Tony in high regard. Tony has created a space where myself, and other minority mortgage bankers, first felt like we were part of the industry.

During the recording for episode 13, I wanted to find out from Tony if he saw a shift in perception from within the mortgage industry rooted in what we were seeing daily on the TV news. His answer was, “Yes.” He expanded on the thought saying there were companies reaching out to NAMMBA to seek assistance on how to best make all their employees feel like they belonged. More leadership teams wanted to set the proper tone to allow for more open dialogue on the topic of race.

A week prior to joining me, Tony had released a personal and moving taped recording of himself talking about the unmistakable racial tensions occurring in the country. He mentioned his two sons in the video and how they perceive America today and their hopes for the future. The big takeaway was “glad the conversation has started; let’s keep talking.” In the first few minutes of Tony’s recording, it was clear he had touched some nerves and had also allowed for the door to swing open further to begin the conversation of inclusivity within the workplace.

Tony mentioned his video during our LL&E episode and the call to action in it, let’s talk to one another about race. It was such a simple idea, yet most simple ideas make the greatest impact. I knew in my life, both personal and business, the greatest unease I felt was when someone wanted to ask me more about my origins. But I could feel they were not sure how to open the dialogue. So here was Tony Thompson saying what I had wanted to say for so many years: just ask! Let’s not assume but let’s talk to one another for the sole purpose of how we may better understand one another.

Tony mentioned his video during our LL&E episode and the call to action in it, let’s talk to one another about race. It was such a simple idea, yet most simple ideas make the greatest impact. I knew in my life, both personal and business, the greatest unease I felt was when someone wanted to ask me more about my origins. But I could feel they were not sure how to open the dialogue. So here was Tony Thompson saying what I had wanted to say for so many years: just ask! Let’s not assume but let’s talk to one another for the sole purpose of how we may better understand one another.

Tony went on to add how, as an industry, we needed to include more women and minorities in leadership roles. This would give a voice to many potential homeowners whose voices have been excluded in the past. Allowing mortgage lenders to give access to more minorities through mortgage programs to assist them with their specific needs would also allow more minorities to be able to identify with a certain mortgage lender representative. There are multiple benefits a company could experience if they executed Tony’s statement.

What I’ve learned in my short time of interviewing people is there comes a time when the guest has found their stride in a certain topic. My job then becomes to allow them the space they need and support them to continue on their topic of conversation, which is exactly where I found myself in such a short time with Tony. I could sense Tony was not only saying what he believed, but this area of conversation was something he was passionate about.

I delved deeper into the topic of talking about our differences. More specifically, people becoming more comfortable asking questions they were confused about, but in the past did not feel comfortable asking. Tony responded with what I deemed to be the quote of the entire interview, “It’s ok to say, I understand I will never understand, but I’m here for you.”

His statement’s simplicity was overwhelming to me. It was full of humility while being supportive of another individual. It allowed people the freedom to talk openly about their differences, while neither party was going to be judged. Maybe I’m imposing my own personal feelings on the statement and making more of it than there is. But in the end, isn’t that what we’re supposed to do? When we hear something and it resonates so deeply within us, aren’t we supposed to be moved?

I told Tony that as the protests were occurring in Washington, DC during the ten days leading up to our interview, I had felt a strange urge to go join them. I further added, of all the protests that had occurred in my hometown, I had never felt compelled to join them. But I found myself in downtown DC with the crowds protesting the injustice that had become even more evident by the video showing the murder of George Floyd. I had seen a few of my industry friends take part in the protest and I just had to be a part of it as well.

The video Tony had shared the week prior had received an outpouring of support. While I was encouraged by this, it had also provoked a question which I need to ask Tony: how I should respond when I see someone publicly supporting Tony’s video about race relations, but I know they don’t really believe in Tony’s message based on my own personal interaction with the individual?

While this question may seem like a question right out of Debbie Downer’s playbook, I had been disturbed by people who celebrated Tony’s video message online, yet, shown me through their actions they did not believe in inclusivity in the workplace. I knew I could not go into details of the actions I had witnessed, or been on the receiving end of, from some of these individuals. I also knew in my heart a social media platform was not the best place to talk about them. So, I refrained from posting my feelings online, but I wanted to know what Tony thought.

In true Tony Thompson fashion, he gave a quickly thought out, yet measured response saying, “It’s not what you say today, it’s what you do three months from now, six months from now, one year from now.”

In other words, your actions are stronger than your words will ever be. Over a certain period of time, life will go back to some form of normal. But the issue of race and being inclusive in the workplace will remain. Will we, as an industry, pivot enough to allow for new thoughts and actions to take hold? I came out of this interview believing the answer to be yes.

***

I am pleased to say it’s been one year since this interview, and I have seen amazing changes within our industry. I have seen more women step into prominent leadership roles. I have seen minorities lead companies to new heights. More and more opportunities are given for promotions within a company to people who had been overlooked in the past. Change has come, regardless of however slow it may have been arriving or, however far we may still have to go.

It has not been lost me that NAMMBA’s sponsorships from mortgage lenders and mortgage-related services have also increased exponentially. With the help of those sponsors, NAMMBA has been able to put into action some of the initiatives it may have not been able to launch without the assistance from industry sponsors.

The first and most important one comings to mind is Mission 2025 to connect 50,000 graduates into careers in the real estate finance industry. I will spare you the mortgage banker average age here, but needless to say, adding 50,000 recent grads by 2025 could begin to reduce the average age.

As of the writing of this article over 1,000 students have signed up for NAMMBA’s talent hub. June 2021 saw the first group of students in NAMMBA’s NEXT GEN program, which will provide them valuable insights into the mortgage industry.

For someone who started in the mortgage business in 1994, this is an amazing time to be in our industry and to witness the seismic shift occurring firsthand. I have always enjoyed my talks with Tony Thompson, public and private, but this particular interview will stick with me for a long time to come. This will reflect to be a point in time when our industry chose to become inclusive.

Fobby is a card-carrying 20/20 Vision Master. Evidence of his inherent professionalism and humanity is exhibited through his words. Not quite as apparent is the great sense of humor he brings into his relationships, both professional and personal.

“Starting in the mortgage industry in 1994 as an inexperienced loan officer, I understand the challenges my sales teams may face on a day-to-day basis. While the industry has changed, I truly believe the blueprint remains the same to achieve success.

I have been blessed to be able to build cross-cultural teams over the past years, which in turn, has really challenged me to better understand people’s individual needs as no two salespeople are identical.

My WHY is knowing every single day there is someone out there who needs a little push in the right direction to take their career to the next level. Once that push is given, the satisfaction I feel in seeing them achieve the desired results is unmatched for me.

Leadership is not about blazing a trail; it’s about supporting your team with the trail that they want to blaze.”

Written by: Michael Hammond, Executive Coach

As a growth coach, many originators who reach out to me want to grow their businesses. The conversation typically starts with them wanting the secret sauce, the magic button, to grow. They want to instantly start talking about lead generation tactics, incredible new social media strategies, new tech promising better outreach, and how to engage realtors to properly drive new purchase business.

The first question I ask them is: what would happen to your business if I handed you 20, 50, 100 new leads today? Invariably, the answer is almost always the same: it would blow up my business. I couldn’t handle that kind of volume. My turnaround times would increase dramatically, customer satisfaction would drop, and in the long run, I would do more damage to my business in addition to not being able to physically handle all of the new business.

My response is precise, “So if that is true, then we need to first start with understanding why your business would blow up with that kind of volume.”

Most of the time, it begins with the lack of clarity in how they are handling loan files. If originators genuinely want to grow their business and create a sustainable lending model, they must master the Manufacturing of Loans.

What do I mean by the manufacturing of loans? It is the stage in business beginning with the initial interest by the potential borrower and continuing until the loan is funded. If this stage is not mastered, originators will struggle with sustainable growth and cap their potential to significantly increase origination volumes.

So, let’s talk about how to master the manufacturing of a loan. The easiest place to start is to think of a spreadsheet. Whether the originator is handling refinances or purchases, the methodology for mastering the manufacturing of a loan is the same even if the actual steps are different.

If doing both refinances and purchases, create two separate blocks of data in a spreadsheet. On the far-left side, you will record the exact process (workflow) an originator follows from initial interest to the funding of a loan. For example, here are some of the specific items originators list in our conversations:

- Initial communication with the borrower

- Input into CRM

- Request documents via email/CRM

- Follow up/receive loan application and documents

- Pull credit

- Organize documents

- Complete loan file.

This process continues all the way to funding.

The key for each person looking to grow is to map out each step of how they manufacture a loan. Do not cut corners here. It is critical to customize this workflow to each specific business. Every lender, originator, loan officer, and broker does this a little differently. Some originators will have 45 steps, while others only have 18 steps. The number of steps doesn’t matter at this stage. What is important is the workflow being specific to the unique business flow. These items will appear in the first column.

Once this is clearly defined, we move to the first column to the right, which is the actual time it takes to complete the specific task. The purpose of this column is to start tracking and understanding how much time is being spent on each step in the manufacturing of a loan. For example, in initial communication, most originators spend 15-20 minutes on this step. Pull credit might take 30 seconds. The amount of time on each phase is not what is essential here. What is important is starting to gain clarity and understanding of how much time is spent on these tasks because they directly impact your ability to grow.

If you are a branch manager or running a larger team, add an additional column to the right, which is the actual time it takes each team member to complete each task assigned to them. For instance, if you filled out how much time it should take for each task (i.e., initial communication 15-20 or pull credit 30 seconds) and in the actual column, it takes one of your team members twice as long, you instantly know there is a problem, and the person needs additional training on the specific task.

A subsequent column is to define a number of files the individual originator or branch manager has at each specific step in the loan manufacturing stages. For example, five initial communications, three pull credits). The magic in these steps is when you multiply the number of loan files a person is working on at each stage. In tracking the time it takes to complete each step, originators gain great clarity about where they are spending their time. This also allows them to start right-sizing their organization for growth.

Let me explain by providing a real-world example. One of the students I coach was convinced they needed another processor. This student is a producing branch manager who has one LOA and one processor. They were looking for me to approve hiring the new processor. I said to fill out the spreadsheet, and then we could discuss. Once they filled out the fields and columns we describe above, guess what they found out? Their processor worked four hours a day, and their LOA was working 10-12 hours each day. By going through this process, they identified they didn’t need to hire another processor. Maybe they needed to hire another LOA or redistribute/reassign some of the LOA items on their plate to the processor. Either way, going through this process instantly gave them clarity. It provided them with the ability to right-size their business through what the facts were telling them instead of making an emotional decision.

The other columns on the spreadsheet include what steps can be delegated and what steps can only be done by you in manufacturing the loan. Once this information is filled out, we add three additional columns: templatized, digitized, and automated. This is where we talk about how to humanize the steps in the process and which friction points can be either reduced or eliminated through templates, videos, and automation. By automating a number of these steps, originators can maximize the efficiency so they can master the manufacturing of loans.

By mastering the manufacturing on loans, they are now poised for growth. This is when we can discuss how to generate leads from post-closed loan nurturing, how to develop realtor relationships, which steps to automate correctly and how to leverage the latest strategies in social media. The key is their business is now ready to handle the increase in new leads while developing a sustainable lending model in the future.

Michael Hammond is responsible for overseeing the daily operations and long-term strategic vision of NexLevel Advisors. A seasoned technology executive, Hammond brings over two decades of leadership, management, marketing, sales, and technical product and services experience. His expertise spans start-ups to multi-billion dollar corporations, running businesses, business units, marketing, sales, strategy, and product and services organizations.

Mr. Hammond brings exceptional insight, leadership, passion, and strategies that create revenue growth, and profitability. Hammond now dedicates himself exclusively to helping other businesses and individuals achieve extraordinary levels of success.

Hammond is only one of 60 individuals to earn the prestigious Certified Mortgage Technologist (CMT) designation, which is presented to information technology professionals in recognition of their industry experience, professional education, and knowledge of the unique technological needs of the real estate finance industry. In addition, he has been and Named “TECH TRENDSETTER” by Housing Wire, “LENDING LUMINARY” by Progress in Lending, awarded “SALES, MARKETING & PR TRAILBLAZER” by Progress in Lending, and Recognized as “TOP 50 MOST CONNECTED Mortgage Professionals” by Mortgage News Network.

In addition, Hammond is viewed as a thought leader within the mortgage technology space and has been published over 100 times in leading real estate finance publications such as Mortgage Banking Magazine, National Mortgage News, Tomorrow’s Mortgage Executive and Today’s Lending Insight. He is also a recognized speaker who regularly presents at national and state mortgage association conferences and other industry-related events.

Hammond received a B.S.B.A. in Marketing from Xavier University and earned a law degree from Michigan State University. In addition, Hammond is Chairman of the Board at Catholic Vantage Financial and serves on the advisory boards at Xavier University and the Progress in Lending Association. He is also an Executive Mentor at Xavier University.

Written by: Laila Khan

“He who cherishes a beautiful vision, a lofty ideal in his heart, will one day realize it.” ~ James Allen

Copernicus fostered the vision of a multiplicity of worlds and a wider universe, and he revealed it. Buddha beheld the vision of a spiritual world of stainless beauty and perfect peace, and he entered into it.

“Cherish your visions; cherish your ideals. Cherish the music that stirs in your heart, the beauty that forms in your mind, the loveliness that drapes your purest thoughts. For out of them will grow all delightful conditions, all heavenly environments; of these, if you remain true to them, your world will, at last, be built.” ~ James Allen

James Allen’s message continues, sharing his view of dreamers as the saviors. Every vision-driven leader knows, if the vision is compelling enough, people will apply their best thinking and efforts to figure it out, regardless of obstacles and opposition. The road map to draft out goals and strategies and pinpoint the trajectory of your organization will revolve around the vision.

But what about the adoption process of that vision, especially if it’s not aligned with the individual? How do we move forward? Do we pack up and leave in search of more alignment?

When working under leadership, one must constantly be willing to outdo oneself, to stretch, to reach out of our comfort zone and see leadership direction as growth opportunity.

No matter the weight of the vision of the company or organization, a leader is charged with the responsibility of finding a way to communicate the vision with a simplicity that triggers actions and defines the roles of others in realizing the vision. On Martin Luther King Jr., Sinek Simon writes, “He was not perfect, he had his complexities. He was not the only one who suffered in a pre-civil rights America, and there were plenty of other charismatic speakers. But Martin Luther King Jr. had a gift. He knew how to inspire people and communicate his vision which triggered massive actions”. For Dr. King, there was no website to post venues and locations for demonstrations or rallies. No group invitation was sent in email. The power, the movement came from the will and the clarity of Dr. King communicating his vision.

A powerful vision inspires enthusiasm, belief, commitment, excitement and ACTION in a company or team.

Part of working towards solidifying a vision is providing clarity on the direction you’re going. How many of us hop in the car without any destination in mind? We don’t.We have our destination in mind before we get behind the wheel. We map out our directions and allow enough time to arrive where we need to be. The same process can be applied with visionary work.

Use your dreams and desires as a roadmap or route, not a mere fantasy. Step into your power and realize the doors are open. Once you overcome your limiting beliefs saying, “you can’t” or “it’s not possible for you,” your options grow exponentially, and you give yourself permission to have that vision. Once you accept can indeed achieve what it is you’re trying to accomplish, you can create a detailed game plan to achieve your vision. Having a plan of action filled with items and small steps makes your vision seem more attainable. Having a plan formulated and clear in your mind also gives you conviction and confidence when communicating it to others.

Big goals often take a long time to realize. As a leader, it’s important every few months to focus on realignment in your team. It is essential to know the HOW– your strategy, the formula you’re going to implement to fulfill your vision. It is also essential to know your WHY–your reason for doing everything. When hardship arrives at your door as you work towards this vision and all you want to do is give up, sometimes it will be your WHY that pushes you to keep going. Get comfortable with knowing your why. Write down your reason and put it somewhere you see it often. Remind your team of it often too.

Having an idea is one thing but to really execute it, one often needs a team of people. This is why having a plan of your vision is important. When the vision is clear and the plan is shared, the team is able to bring the vision to other people and aggressively expand the reach of your vision.

Where are we headed and what are we looking to accomplish? In communicating the vision of the organization, followers follow their leaders, not because of the leaders but for themselves. Importantly, clarity deployed in communicating one’s vision should not be mistaken for sound oratory skills. Steve Ballmer, Bill Gates’ successor as Microsoft CEO, is the stark opposite of the billionaire. Ballmer deploys intense energy in communicating to the staff. On the contrary, Bill Gates is a social misfit who communicates with less energy and great clarity. This vision-sharing approach was crucial to the foundation of the company’s success. Leadership is understanding the Why and communicating both the How and the Why.

In the mortgage industry, your competitive advantage may depend heavily on the uniqueness of your services. Breaking the conventional approach in an industry through a unique style of service involves a shared goal. Harnessing the human resource in every business and attaining the desired height of the company requires a shared vision.

Notable effects of a shared vision.

- Shared vision inspires commitment and productivity

Vision provides the blueprint of an organization’s aspirations. A shared vision is a propelling force for the team, and if it is appropriately communicated by the leader, it integrates members of the organization and ensures the activities of each department are aligned towards the goal or vision of the business. The simplicity employed by a leader in communicating the vision, and the frequent reminder of the organization’s goals inspires a sense of belonging that triggers productivity. The clarity of Walt Disney’s shared vision stirred a sense of responsibility in Roy Disney and many others who laid the foundation for the company’s success. As Simon Sinek noted, a shared vision has the capacity to inspire people to contribute something bigger than themselves.

- Shared vision creates a strong sense of followership

A shared vision inspires a strong sense of following, which creates the impetus for repeated success in other areas. Great companies lay the foundation of their business by creating a picture of their goals and educating their employees on their functions. Richard Branson excelled with Virgin records, then applied a similar principle in his airline, which also became one of the famous names of the industry. He applied the same principles with his soda company, insurance company, and other huge businesses he owned. Apple has diversified successfully from computers to phones and MP3. The common feature of these companies that replicates their success is a shared vision.

- Shared vision creates momentum for explosive growth

When John Schnatter began his pizza business in 1984, he was a twenty-two-year-old trying to make ends meet and managing a lounge with his father. The following year, John named the company Papa John’s. In the early months of 1991, Papa John’s had 46 stores. Towards the end of the same year, the number of stores increased to 110, and 220 the following year. Seven years later, the number was at 1600 stores. At his early stages, Schnatter admits being obsessed with the company’s goal – he wasn’t communicating his visions, nor was he concerned about giving them the sense of belonging that created an atmosphere of excitement.

Leaders and business owners often get obsessed with the execution of their goals without feeling the necessity to share the goals and vision of the organization. A shared vision with other team members stirs up a desire to acquire the specific skill required to maximize growth in an exciting atmosphere.

Vision Inspired Action and Legacy

Successful companies with leaders who understand the need to share their vision do not experience a downturn even after the death of their CEO. When Roberto Goizueta took charge of Coca-Cola in 1981, the company’s value was around $4 billion. Under his leadership, the company‘s value became $160 billion. Despite his tremendous influence, Coca-Cola didn’t experience a downturn in value after his death in 1997. Goizueta understood the effect of shared visions as the key to efficiency and continuity. In all industries and companies, a shared vision and clarity of expression are crucial to an organization’s success to carry on the legacy and continue the momentum for years to come.

Laila Khan is the assistant vice president of marketing and communications for Guidance Residential where she brings her unique talents to promote success for both the company and the team she works with. Her emphasis on the customer journey and marketing strategies directly impacts her company’s visibility and brand awareness generating more leads and building partnerships.

Laila believes home is where the heart is, and with her 24+ years of experience, she has found her heart is in the niche space. Her network is broad and strong. She loves working with her company teams to secure home financing and help customers meet their needs, goals, and dreams of homeownership. She focuses on enhancing the customer experience, lead generation and conversions, and optimizing digital presence across platforms.

Laila believes home is where the heart is, and with her 24+ years of experience, she has found her heart is in the niche space. Her network is broad and strong. She loves working with her company teams to secure home financing and help customers meet their needs, goals, and dreams of homeownership. She focuses on enhancing the customer experience, lead generation and conversions, and optimizing digital presence across platforms.

“I simply love building relationships, learning from others, and closing the gap.”

Laila believes in leading by example and doing all she can to ensure team members are personally and professionally fulfilled. She considers these basic tenants of a servant leader to be the core of her success and strengths, personally and professionally.

“I believe in legacy building, purposeful work, and servant leadership. As an advocate of a balanced work-home life and giving back, I value spending time with my husband and raising our three children.”

Laila’s downtime is dedicated to volunteering, tutoring, and investing in community building. She also enjoys being a Tae Kwon Do mom, a DECA mom, and a Girl Scout troop leader, serving and paving the path for our future leaders.

Laila is a contributor to several industry magazines. She has been recognized and received numerous awards including Top 20 Sales, Marketing, and PR Trailblazer Progress in Lending, 2020 Women With Vision Award, and the Path to Diversity and Inclusion.

Work From Home (WFH): To remote or not to remote, that is the question.

Written by: Ruth Lee, CMB

It appears the bloom is off the rose. After a year and a half of working from home, the benefits of work from home (WFH) are not quite as novel, working in your professional loungewear is not as cool, and teams find themselves missing the creative energy of working in a centralized location, and I don’t mean Zoom. But this does not mean we are going back to the way it was. I believe we are in a new phase made possible by the experience of the last two years. Executives and team leaders are weighing their options for WFH, and here are a few thoughts to help you excel in the successful implementation of your policy.

Policy.

Whether you are building a remote team, rebuilding a primarily in-office work environment, or embracing a hybrid remote practice, building a policy addressing where people work and how they meet the company’s needs from their location is essential. As a leader, you need to offer specific clarity and guidance while leaving yourself open to evolving the policy in the future as needs arise. For now, look at each position. Decide if the process can be effectively handled remotely or if it requires a deeper collaboration a Zoom meeting cannot fulfill. Consider the experience level of the team, their need for hands-on training or guidance, how productivity is impacted by working alone or behind a webcam, and whether you can successfully manage each position in a remote environment.

Make sure you have policies to address how to Zoom (i.e., faces are seen not pictures, names, or avatars) and whether a WFA (work from anywhere) policy meets your company’s or team’s needs. WFA may depend on cell phones and internet reliability, which may or may not best achieve the needs of all the roles for your staff.

Does the policy foster your short- and long-term goals? For example, if you are looking to scale, can scaling be accomplished effectively from home, or do you need to have an office environment to anchor the team as required? These questions will have an important impact on how you hire and recruit. Building a thoughtful and well-reasoned policy now will have a huge impact on both you and your employees.

Culture.

A remote online culture is hard to foster. In the office, the opportunity for impromptu lunches, meeting in the kitchen to catch up while something heats up in the microwave, or brainstorming in front of a whiteboard, are activities we took for granted. We no longer have those luxuries with WFH, and now we also must combat loneliness, feelings of isolation, and Zoom burnout. Again, start thinking about the culture and values you and your team will embrace. Have a plan for how to build your corporate culture through Zoom and/or occasional in-person meetings. While you may give up your office, you will still need to invest in retreats, group training, and other activities to hold the culture together.

The remote culture is tough, but a failure to focus on your culture will leave you with consistent employee turnover, a lack of consistency in your customer service, and a loss of brand identity. Perform a Google search and find guidance on how other companies are handling this momentous change. You are not alone. Everyone is experimenting with new paradigms. Think about specialized training for your management team focused on improving their communication, identifying employees who are struggling, holding successful and productive meetings, and distributing critical information and training to everyone.

Style Points.

Fumbling through a challenge like working from home is never a great idea. This is a sea change for many employees, and we are often still working out the finer points of doing this well. As we discussed, thinking about how you embrace, partially embrace, or reject WFH out of hand, is a corporate decision for you and your team. Whatever decision you make, own it. Your policy and the adaptation of your culture reflect you and your values. This is not something to apologize for or explain again and again.

Make the decision a benefit of working for you and your team. Acknowledge the ways you have adapted your process, technology, and culture to fit your new business model. This is now a part of your brand, and you owe it to yourself to do it with style. From town hall meetings to escape rooms to lunch and learns, make this fun. Maybe you do not have an office so now you have a corporate trip to Mexico. If you are all-in on being in the office, consider letting people bring their dog in a couple of times a week.

Ruth Lee is a well-known, highly published industry expert on mortgage operations, compliance, servicing, and technology. Having built and sold two companies in the mortgage industry, one a mortgage lender out of Austin and one a mortgage services firm out of Denver, Ruth offers a unique perspective on the marriage of sales, operations, and overall business growth.

Ruth graduated from Future Mortgage Leaders in 2007 and most recently co-authored the MBA’s Servicing Transfer Best Practices. Ms. Lee seeks every opportunity to consult and counsel on the practical implementation and impact of operational, regulatory, and legislative changes.

Ms. Lee holds a B.A. in Economics from Mount Holyoke College. She resides in Lakewood, CO with her husband Mike, her black lab Ned and two cats, Jefferson and Adams. Winter months find her and Mike riding every peak they can find.

.

WHAT'S REALLY GOING ON IN THE HOUSING MARKET?

Written by: Megan Anderson

High temperatures aren’t the only thing setting records this summer. Home prices continue to appreciate at record levels but there is more to this story than the media often reports.

There are many misperceptions generated by the media, which are sparking fear among buyers right now. One of these is the misunderstanding regarding affordability. There is so much media sensationalism about housing currently being unaffordable, and while home prices have escalated, it’s important to look at the right metrics and calculations to determine whether home prices are truly in an affordability crisis.

Median Home Price is NOT the Same as Home Price Appreciation

When the media talks about rising home prices, they often reference the median home price and talk about the gain or decline in median price as appreciation or depreciation of home values. The median home price simply measures the middle-priced home sold in a given timeframe, meaning half the homes sold above that number and half below that number.

For example, the median home price for Existing Home Sales in May was reported at $350,300, up almost 24 percent year over year. But this doesn’t mean home values have risen 24 percent. A $350,300 median home price simply means the middle-priced home sold was $350,300, with half the homes selling below and half above that price. Since there is a lack of inventory, especially on lower-priced homes, there are fewer sales in the lower price range. Also, since the inventory of higher-priced homes is more abundant, the increased number of sales of higher-priced homes due to their availability is skewing the median home price significantly higher.

Recently, there have been 30 percent fewer sales of lower-priced homes, while sales of homes between $500,000 to $750,000 were up 122 percent, homes between $750,000 to $1 million were up 178 percent, and homes above $1 million were up 245 percent.

Real appreciation, on the other hand, measures the year-over-year increase of a home’s value. Over the past 12 months, home appreciation was reported to be up 15 percent as per the Case-Shiller Home Price Index, and while this is robust, it is still well beneath the 24 percent rise in the median home price.

In fact, there could be times when home prices could be flat or even falling and the median home price could move up simply by having more purchases at the upper end of the price scale than on the lower end.

Said another way: If there were no homes available for sale under $350,000 and all the purchases were above this amount, the median home price would move up, but this doesn’t mean home prices themselves are rising. It just means more of the purchase mix fell on the higher side.

Don’t let your clients be fooled by any myths or incorrect metrics they may hear in the media.

Are Homes Still Affordable?

After a 15 percent rise in home prices, there are many questions regarding whether homes are still affordable. This is where math can help. While home values are going up, so are incomes. A common error made within the media is the belief that incomes need to rise by the same percentage as home values. But in a relatively stable interest rate environment, you only need a fractional increase in your salary relative to the rise in home price.

For example, if a mortgage payment of principal and interest for a home a year ago was $1,000/month then your income would likely be in the range of $5,000/month. If a year later, in a stable rate environment, the home value rose by 15 percent, the monthly payment would also rise 15 percent or $150/month. If your income were to rise over the past year by the same $150/month you would effectively be at the same level of affordability as you were a year ago. Since you do not use all of your income to pay your mortgage, a $150/month rise in income would translate to a 3 percent increase. Currently, weekly earnings are rising by more than 7 percent year over year.

Is This a Good Time to Buy?

If you have clients who are hesitant to buy a home because they’ve heard talk of a housing bubble, or they’re worried the median home price is too high, you can use MBS Highway’s Real Estate Report Card to show them the strength of the market; right in their specific county or zip code.

Let’s break this powerful tool down using Harris County, Texas as an example, so you can see how you can use MBS Highway’s Real Estate Report Card to help your clients move forward with a home purchase and to gain valuable referral relationships. Again, you can use this tool for any county or zip code across the country.

Healthy Historical and Forecasted Appreciation

Let’s first take a look at the opportunity in housing and affordability. The median home price in Harris County is $222,625. We have strong appreciation with the 10-year historical appreciation rate at 4.09 percent, while the forecasted 1-year and 5-year cumulative appreciation rates are a healthy 3.56 percent and 13.01 percent, respectively!

We know these rates of appreciation are strong, but to really drive this point home to your clients, it’s important to explain what this means to them. Purchasing the $222,625 home today, given the forecasted appreciation rate of 13.01 percent over the next five years, means the buyer will gain $28,966 in appreciation alone! Being able to demonstrate this tangible gain clearly and visually for potential clients can help spur them to act now, which can certainly help you increase your production and build valued referral relationships. A similar story is happening everywhere in the country.

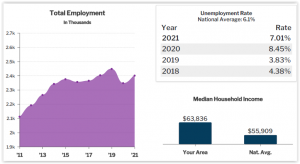

You may have customers who wonder if they can afford a home in this area. You can use the Real Estate Report Card to show them affordability is very strong in this market, as evidenced by the Affordability Index of 175.09. This means a family earning the median household income for Harris County of $63,836, which is well above the national average of $55,909, can afford 175.09 percent of the median home price when putting 20 percent down.

Of course, not everyone is putting 20 percent down, but you can see how this information gives homebuyers a good gauge of what they can afford, helping you build your pipeline and build relationships with both new and trusted referral sources.

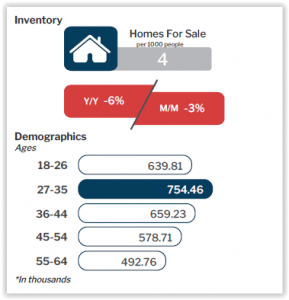

Tight Inventory Likely to Remain So

We can see there are just four homes available for every 1,000 people in Harris County. Inventory is down 6 percent year over year and 3 percent month over month.

We can see there are just four homes available for every 1,000 people in Harris County. Inventory is down 6 percent year over year and 3 percent month over month.

Homes are definitely moving and it’s crucial to communicate to hesitant clients it’s probably not going to become easier to purchase a home. Here’s why:

Based on our demographics, there are currently 754,460 people who are between 27-35 years old. This number is important because those in this age range are first-time homebuyers, and our goal is to see what kind of business we can gain from this demographic and how we can help them benefit through homeownership.

Out of these nearly 755,000 people, 71,670 will either rent or purchase a home in the next year. Out of these 71,670 household formations and considering Harris County has a healthy 55 percent homeownership rate, around 39,530 will purchase a home.

To meet this demand, builders would have to build 39,530 homes each year, or this number of homes would have to become available for sale. Yet the actual number of homes being built is far below this, at just over 23,000.

This inventory and demographic data combined provide such an easy way to express to potential clients why they shouldn’t delay their purchase, which again can help you increase production and gain the trust of key referral sources.

The bottom line is we have an inventory shortage, and this is a big reason as to why now is such a good time to purchase a home before it becomes even harder if inventory tightens even more or rates move higher due to rising inflation or other reasons. Plus, there’s also the strong forecasted appreciation rates as discussed above and the fact that homes are selling fast.

Strong Job Market Bodes Well for Housing Market

We’ve seen steady job growth in Harris County over the past few years. Of course, last year with COVID-19 it was a different story as it was across the rest of the country, but we already see job growth coming back strong and anticipate that strength and growth to continue.

We’ve seen steady job growth in Harris County over the past few years. Of course, last year with COVID-19 it was a different story as it was across the rest of the country, but we already see job growth coming back strong and anticipate that strength and growth to continue.

The current unemployment rate is at 7.01 percent in Harris County. Though this is higher than the national average of 6.1 percent, we expect to see the unemployment rate decreasing further as the economy continues to reopen.

A strong job market is another reason the housing market is expected to remain strong in the Harris County area, as people are more inclined to purchase a home when they feel secure in their job. The opposite is also true.

MBS Highway’s Real Estate Report Card can be created for any county or zip code across the country, and it’s just one of the many tools MBS Highway has and can be the crucial differentiator in turning prospects into buyers who have won their dream home, and turning originators into advisors their clients can trust. With an MBS Highway membership, you’ll have access to all of our tools, including Bid Over Asking Price, Buy vs. Rent Comparison, Loan Comparison tools, daily coaching videos, lock alerts, and much more.

Do you want analysis like this on daily basis? Try all of these tools for free with a 14-day trial and see for yourself the kind of difference they make in your business!

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

Megan Anderson is a well-known professional speaker, teacher, and winner of HousingWire’s 2020 Women of Influence award. She is also the winner of the 2019 40 under 40 award and 2019 Women with Vision award. She has introduced systems and platforms that effectively create content and increase engagement.

She is vice president of Marketing at MBS Highway, the industry’s leading platform for mortgage sales professionals. Megan has helped eliminate the fears and obstacles mortgage and real estate salespeople have in creating video content. Her innovative pieces of training have transformed salespeople into local celebrity advisors.

Megan is a highly sought-after speaker and coach who is passionate about helping others grow their business and gain more confidence in themselves. She is also the host of the podcast Behind the Breakthrough, a podcast telling the untold stories of success.

YOUR ULTIMATE POTENTIAL IS IN FRONT OF YOU WAITING

Written by: Jenny Mason

It starts with believing in yourself. Believe in this truth: when you put in the effort and add perseverance, you can reach your ultimate potential!

We live in an Insta-society, filled with microwaves, air fryers, Insta Pots, and Instant Messaging. We have become programmed to receive instant results which leads to frustration on many fronts. Consistency and persistency are conducive to instant results. It’s important to retrain our thinking and remember consistency and persistency are keys to success in most undertakings. When we are consistent and persistent in our actions and we are conscious of our behavior, we develop regular habits which help us reach our desired outcomes. In every case, reaching a goal increases our motivation to continue and creates forward motion and lasting results. Focus on the process and not the results. Improve yourself by one percent every day. This quickly adds up to hefty compound interest. Focus on the activity, and the results will come!

“An object at rest stays at rest, and an object in motion stays in motion.” Once you have momentum you are in motion and far more likely to stay in motion.

Think about how many times you have stalled in the process of attaining a goal. Perhaps you became overwhelmed; believe it to be too much, or impatience won out and the goal was too far off. By breaking goals down into small steps you achieve the results you want. Attaining small goals adds fuel to our fire and keeps us moving forward instead of stalling out. Progress is fuel to propel us to keep going forward. Make the goals too small to fail. Let’s say you decide to make five calls instead of 100, lose five pounds instead of 50, do five pushups instead of 50, crush the next 50 minutes rather than the entire day.

It’s hard to feel inspired when you feel like your goal is so far in the distance. But, when you crush one task, you have the steam and the momentum to do one more, then one more, and the next thing you know you are the little train starting the climb saying, “I think I can, I think I can. Before you know it, you will be saying “I know I can” and you will be chugging up the hill.

Celebrate each step forward. After a call give yourself a fist pump, drink a glass of water instead of a soda, fist pump, make five calls, fist pump, work 50 minutes uninterrupted, fist pump, and so on Celebrating those tiny wins really helps with motivation. It boosts our emotions knowing we are making progress in the right direction. It makes us happier and we know we are most productive when we are happy. Did you know holding your hand in a fist or standing in a power pose makes you feel stronger? (Think it’s silly? Try it!)

Don’t become caught up in the speed of the progress or looking at someone else. This is your race meant only for you. Enjoy the journey and increase at a manageable pace. Many times, comparing our race to someone else’s results in frustration, depression, and leads us off the path we are meant to run. Oftentimes, we miss out on what’s happening in front of us by looking at the guy next to us. Missing the path results in ending at an unfulfilled destination.

Remember this. Results, even insta results are like slow cooked brisket or BBQ ribs; faster isn’t always better. For instance, I guarantee you they taste a lot better when they are cooked low and slow, instead of on high in a microwave. Many times, trying to be fast causes us to lose our flavor, if you will, our zest. It tires us out mentally and physically. Slow and steady progress is better than developing burnout on both ends and throwing our hands up in disgust. Do a temperature/doneness check from time to time to ensure you are cooking and not burning.

Allow yourself time to rest. Think of working with yeast to make bread. You have to let it rest after it’s been kneaded so it rises to its best form. The same is true with you; this life is kneading you and at times beating you down, so you have to allow yourself times to rest, times to be still, to reflect, then you move on and rise.

Don’t let yourself become impatient during those times of rest, even though it seems like you aren’t getting anything done. Studies have shown that rest boosts your immune system, improves your memory, stimulates creativity, helps you stay mentally and physically fit, improves productivity, improves your health, and makes you happier.